The electric vehicle (EV) landscape in India is undergoing a remarkable transformation, evident from the robust sales surge observed in the first half of 2023. Canalys, a prominent market research firm, has reported that the sales of EVs in India doubled in comparison to the previous year. The data reveals that a total of 2 million light vehicles, encompassing passenger cars and light commercial vehicles, were sold within the first six months of 2023.

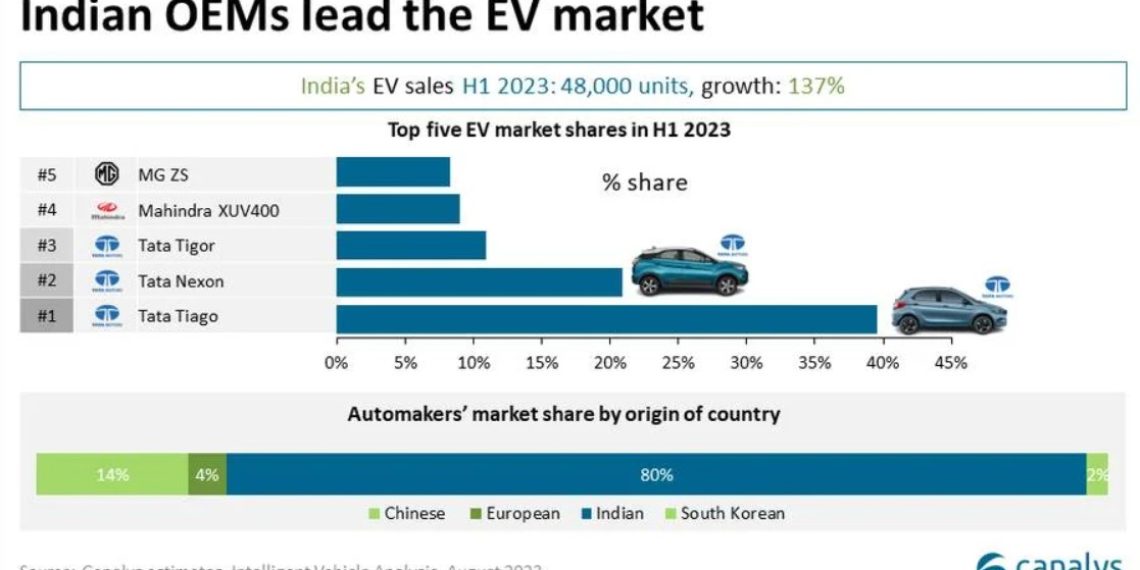

In contrast, the corresponding period in 2022 saw sales figures of 1.8 million units. Among these, a notable segment consisted of 48,000 EVs, which translates to a 2.4% market share. This substantial rise in EV sales marks an impressive 137% year-on-year growth.

Tata Motors Drives the EV Momentum

In the dynamic landscape of India’s EV market, Tata Motors stands as a dominant force. The company has achieved remarkable success by capturing a substantial 72% market share during the first half of 2023. Tata Motors‘ popular EV models, including the Tiago, Nexon, and Tigor, played a pivotal role in this achievement by becoming top sellers in the Indian EV scene.

Following Tata Motors, MG Motor and Mahindra secured the second and third positions in terms of EV sales. MG Motor obtained a market share of 10.8%, while Mahindra captured a respectable 9% share. MG Motor’s success story was attributed to the popularity of the MG ZS and MG Comet (also known as the MG Air), which gained significant traction in specific markets.

Diverse Competitors Emerge

Mahindra, renowned for its XUV 400, also made a substantial impact by securing a commendable 9% market share. Additionally, Citroen entered the fray with its eC3 EV, garnering a 3.5% share. This trend underscores the favorable response from the market towards more budget-friendly compact EV options.

The Chinese automaker BYD, which introduced the Atto 3 electric SUV in India early in the year, managed to capture a 2.9% market share in the first half. However, the company’s plans to invest significantly in the Indian market reportedly faced obstacles amid concerns over Chinese investments.

Industry Pioneers and Future Prospects

Hyundai, a significant player in the global automotive sector, launched its second EV in India, the Ioniq 5. Sharing a platform with the Kia EV6, the Ioniq 5 signifies Hyundai’s commitment to the Indian EV market. The company also announced its intentions to introduce five more EV models by 2032. Meanwhile, Maruti Suzuki, India’s leading car manufacturer, revealed its plans to release its inaugural EV in 2024, with ambitions to launch six additional models by 2030.

“Despite increased competition in 2023, Canalys expects Tata to continue to dominate the market, with the Tiago remaining the most affordable EV in the market,” stated Ashwin Amberkar, an Analyst at Canalys. The surge in EV sales, diverse offerings from various automakers, and ambitious plans for electrification underscore the rapid transformation of India’s automotive landscape. As EVs gain momentum, the future promises exciting developments in sustainable transportation.