India’s smartphone market delivered modest volume growth but strong value expansion in 2025, reflecting a clear shift in consumer preference toward higher-priced devices, according to Counterpoint Research’s Monthly India Smartphone Tracker. While overall shipments grew just 1% year-on-year (YoY), market value surged 8% YoY, underlining the growing importance of premium smartphones in shaping industry dynamics.

The year was marked by uneven demand cycles, inventory corrections, and rising component costs, but also by record-breaking premium adoption and improved financing-led upgrades.

Uneven Start, Stronger Momentum in the Middle of the Year

The Indian smartphone market began 2025 on a cautious note. High channel inventory levels and a limited number of new launches weighed on shipments during Q1, leading to subdued activity across price segments.

Market conditions improved from Q2 onwards as brands refreshed portfolios and ramped up channel stocking ahead of the festive season. This momentum peaked in Q3, which delivered the highest-ever quarterly smartphone market value in India. However, shipments moderated again in Q4 as brands shifted focus to inventory correction amid rising memory and component costs.

Despite these fluctuations, the market closed the year with positive growth, driven primarily by premiumisation rather than mass-market expansion.

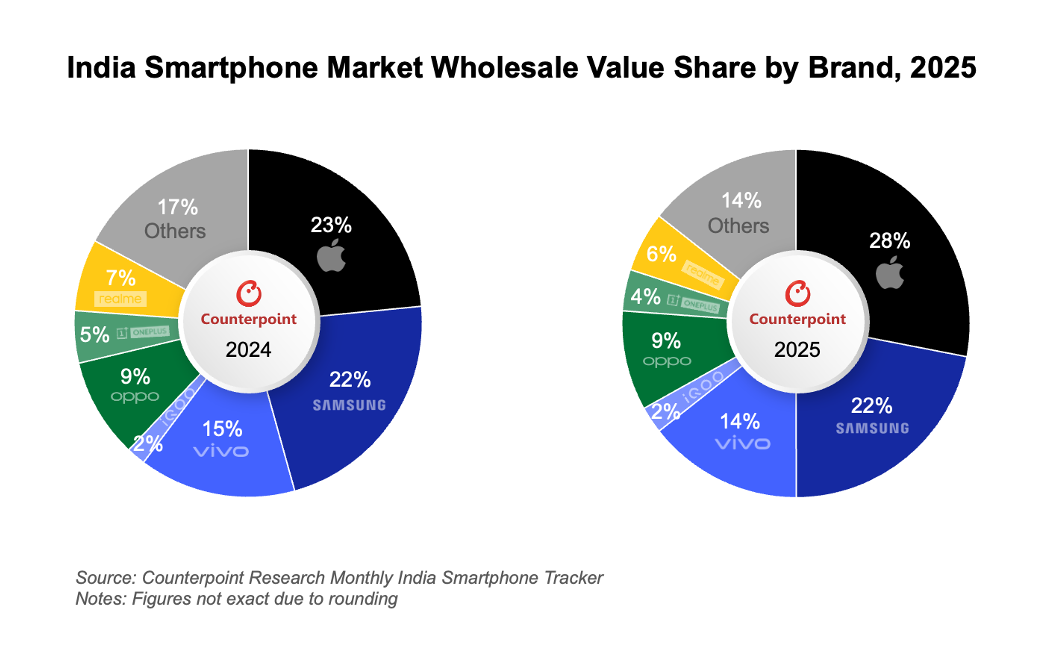

Premium Smartphones Drive Market Value Growth

Counterpoint noted that India’s macroeconomic environment remained relatively stable throughout 2025. Controlled inflation, steady domestic demand, and repo rate cuts helped ease financing conditions, enabling consumers to upgrade to higher-priced smartphones.

According to Tarun Pathak, Research Director at Counterpoint Research, OEMs strategically rebalanced their portfolios to align with these conditions, placing greater emphasis on premium and near-flagship devices.

Key Premium Segment Trends

The premium segment (priced above ₹30,000) grew 11% YoY in volume

Premium devices accounted for 22% of total shipments, the highest share ever recorded

Apple achieved its highest annual value share in India

Entry-level shipments below ₹15,000 faced pressure due to higher memory and component costs

Brands with a strong premium mix maintained margins through disciplined pricing and consistent flagship demand

Advanced camera systems, flagship-grade features, and attractive financing options played a critical role in accelerating upgrades and boosting overall market value.

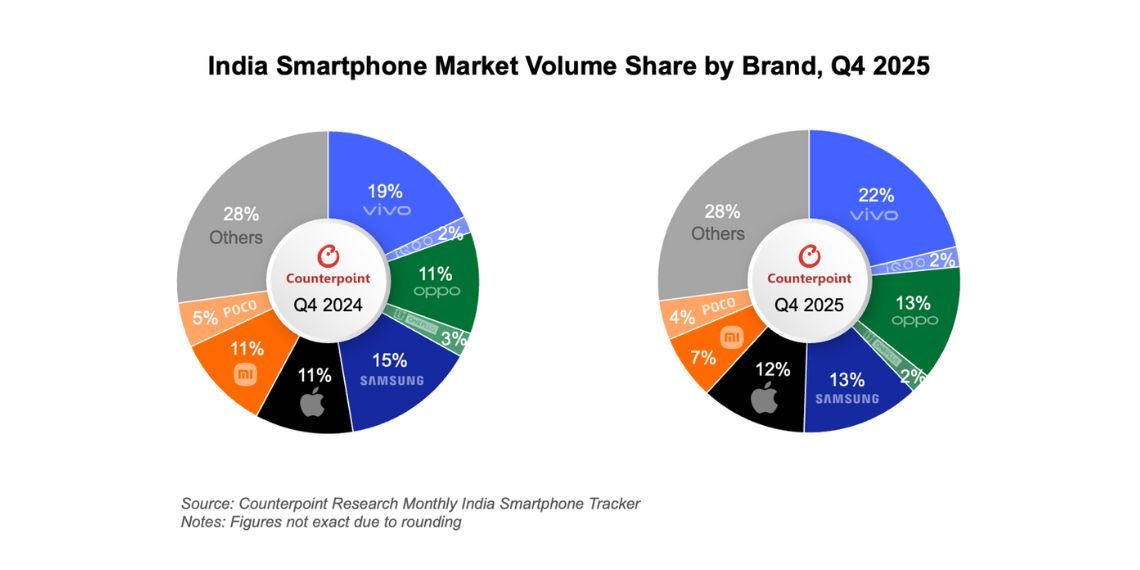

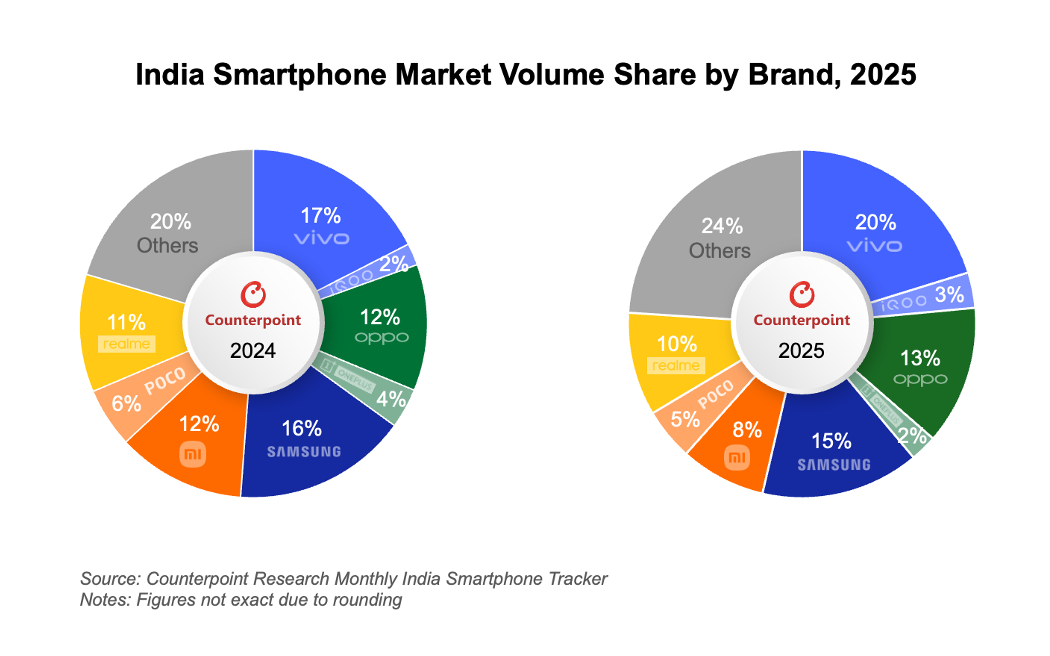

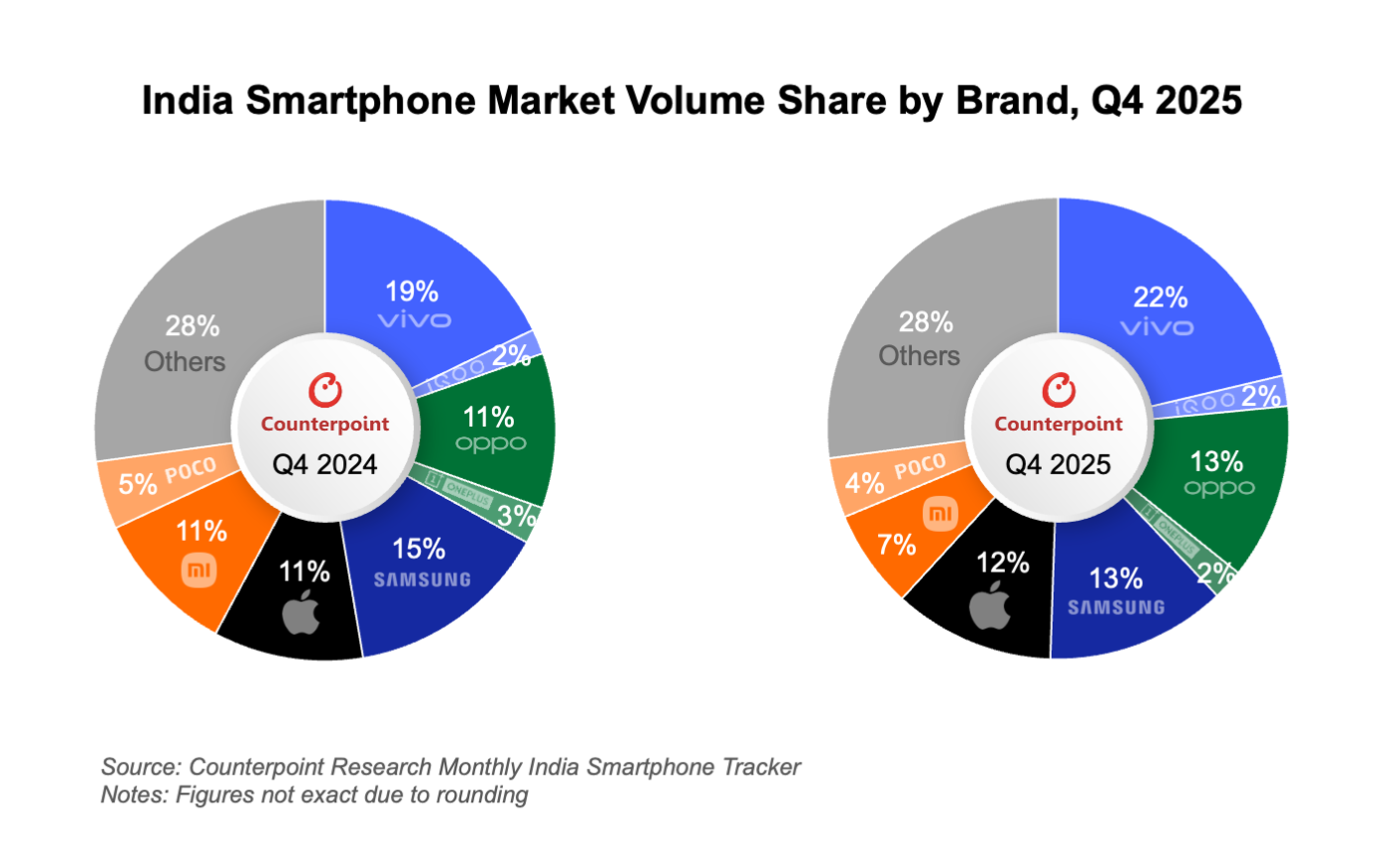

Brand-Wise Performance and Market Share Highlights

Vivo Leads the Market in Volume

Vivo (excluding iQOO) emerged as the market leader in 2025 with a 20% volume share. The brand adopted a dual strategy, driving volumes through the Y and T series while accelerating premium growth via the X series.

The Vivo X series recorded an impressive 185% YoY growth, aided by its ZEISS camera partnership and the launch of the X200 FE, positioned between the V series and flagship offerings.

Samsung Strengthens Its Premium Position

Samsung secured the second position, supported by steady demand across the A, M, and F series. The brand also saw rising traction in the premium segment, with the Galaxy S series achieving its highest-ever shipment share in India.

OPPO and Apple Continue Strong Performance

OPPO (excluding OnePlus) ranked third, driven by the A and K series in the mass market. Apple recorded 28% YoY growth, benefiting from deeper penetration beyond metro cities, improved channel execution, and strong festive demand. The iPhone 16 emerged as the top-shipped smartphone model of 2025.

Key Market and Technology Trends in 2025

Several technology and consumer trends defined India’s smartphone market during the year:

Q4 shipments declined 4% YoY due to weaker post-festive demand and higher memory prices

MediaTek led chipset shipments with a 47% share, followed by Qualcomm at 29%

Motorola recorded 54% YoY growth, making it the fastest-growing major smartphone brand

Samsung dominated the foldable segment with 88% volume share and 28% YoY growth

Financing accounted for 40% of total smartphone sales, rising to nearly two-thirds in the premium segment

Dolby Atmos support expanded as audio quality became a stronger purchase consideration

Average battery capacity increased by around 9% YoY, emerging as a key differentiator

Average RAM levels rose by approximately 5% YoY, reflecting growing AI and on-device processing needs

CMF Records Breakout Growth in India

CMF posted an impressive 83% YoY growth in 2025, including 59% YoY growth in Q4, making it the fastest-growing brand in its segment. The brand is now legally incorporated in India, reinforcing the country as its primary operational base.

This growth follows Nothing’s $100 million manufacturing joint venture with Optiemus, strengthening India’s role as a key manufacturing and export hub for both CMF and Nothing-branded devices.

Nothing Emerges as the Fastest-Growing OEM in Q4

Nothing recorded 32% YoY growth in Q4 2025, supported by expanded offline retail presence across major Indian markets. Channel partners cited clean software, reliable connectivity, and distinctive design as key demand drivers.

The company continued to scale local manufacturing under the Make in India initiative and announced plans to open its first flagship retail store in Bengaluru on February 14, 2026, aimed at showcasing its growing ecosystem.

Outlook for India’s Smartphone Market in 2026

Looking ahead, Counterpoint projects a single-digit decline in smartphone shipment volumes in 2026, primarily due to rising memory and component costs affecting the sub-₹15,000 segment.

However, average selling prices (ASPs) are expected to increase by 5–7% YoY, supported by continued premiumisation and higher device prices. As a result, market value growth is likely to remain resilient even as overall volumes soften.

Conclusion

India’s smartphone market in 2025 reflected a structural shift rather than a volume-driven expansion. While shipment growth remained modest, strong premium demand, improved financing access, and evolving consumer preferences pushed market value to new highs.

As brands increasingly prioritise premium portfolios, AI-driven features, and differentiated user experiences, India’s smartphone market is transitioning from scale-focused growth to value-led maturity—a trend that is set to continue into 2026.

Follow Before You Take on:

Latest Technology News | Updates | Latest Electric Vehicle News | Updates | Electronics News | Mobile News | Updates | Software Updates

📌 Facebook | 🐦 Twitter | 📢 WhatsApp Channel | 📸 Instagram | 📩 Telegram | 💬 Threads | 💼 LinkedIn | 🎥 YouTube

🔔 Stay informed, Stay Connected!