The Indian government has taken a significant leap forward in advancing its space sector, with the Union Cabinet, chaired by Prime Minister Narendra Modi, approving a ₹1,000 crore venture capital fund dedicated to space startups. This initiative, to be managed under IN-SPACe (Indian National Space Promotion and Authorization Center), is designed to bolster the Indian space ecosystem by supporting startups across the space supply chain and creating substantial employment opportunities. Here’s a breakdown of the fund’s deployment and its broader implications.

Key Points

Fund Approval: The ₹1,000 crore venture capital fund will support space sector startups.

Investment Range: Investments range from ₹10 crore to ₹60 crore, based on startup stage.

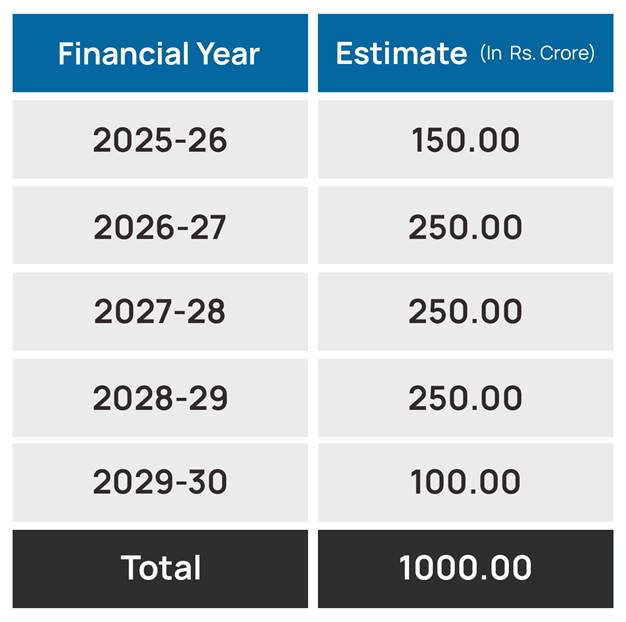

Deployment Period: Up to five years, with ₹150-₹250 crore deployed annually.

Economic Impact: Expected to boost employment, foster innovation, and grow India’s space economy.

Strategic Objectives: Positions India for global leadership in space, supporting the Atmanirbhar Bharat mission.

Aims and Objectives of the Space Sector Venture Fund

The venture capital fund is crafted to address critical needs in the space startup ecosystem, with an investment range calibrated according to the company’s growth stage. Early growth-stage startups will receive between ₹10 crore and ₹30 crore, while late-growth-stage companies could see investments ranging from ₹30 crore to ₹60 crore.

The fund is expected to support approximately 40 space startups, propelling India’s space technology advancements, fostering private sector engagement, and addressing the need for significant capital investment to scale these businesses.

Features and Impact of the Fund

Financial Injection for Scaling and Innovation

The venture capital fund is structured to encourage long-term growth in India’s space sector. The deployment, spread over a five-year period, will average around ₹150-₹250 crore annually, depending on demand. This capital infusion is intended to create a multiplier effect, attracting additional private investment to help companies transition into more advanced stages of development.

Strategic Positioning in the Global Space Economy

By building up its space startup ecosystem, India aims to strengthen its position as a major player in the global space economy. The Indian space sector, valued at $8.4 billion, has a target of reaching $44 billion by 2033. The fund seeks to address current financial gaps, positioning India as an attractive space-tech hub and driving its competitiveness worldwide.

Boosting Employment and Skill Development

Investment from this fund is anticipated to generate both direct and indirect employment across various technical and support fields. Direct job creation will span roles in engineering, software development, data analysis, and manufacturing, while indirect opportunities will emerge in areas like supply chain management and logistics. A strengthened startup ecosystem will foster innovation, enhance India’s global space competitiveness, and cultivate a highly skilled workforce.

Employment Generation and Economic Growth

This fund is seen as a catalyst for job creation across the space sector’s entire supply chain: upstream, midstream, and downstream. The space industry’s growth will lead to thousands of jobs in engineering, data analysis, software development, and manufacturing. It will also create a ripple effect in logistics, professional services, and supply chain roles, directly impacting India’s skilled workforce and driving long-term sustainability in the industry.

A “Booster Dose” for the Indian Space Economy

As part of its space sector reforms initiated in 2020, the Indian government established IN-SPACe to oversee and support private sector involvement in space activities. The fund’s ₹1,000 crore investment is an extension of this commitment, aimed at growing India’s space economy through venture funding and government support. With over 250 startups already in the Indian space value chain, this financial backing comes at a crucial time to prevent potential talent from seeking opportunities overseas.

Building Investor Confidence and Attracting Private Capital

This government-backed fund is set to instill confidence in private investors by demonstrating the government’s commitment to advancing space sector reforms. Structured as an alternative investment fund under SEBI regulations, it will provide early-stage equity to startups, equipping them to scale and attract future private equity investments. This influx of funds is expected to draw private capital into the sector, creating a more vibrant space economy.

Conclusion

With the approval of this ₹1,000 crore venture capital fund, India is making a bold move to expand its space economy, support the growth of indigenous startups, and enhance its global competitiveness. By addressing the financial and strategic needs of the space sector, the fund is set to drive technological advancements, job creation, and economic growth, contributing to the long-term goals of Atmanirbhar Bharat and positioning India as a leading space power. Through this landmark decision, the government is signaling a clear commitment to innovation, fostering a self-reliant and globally competitive space sector.

Follow Before You Take on Facebook | Twitter | WhatsApp Channel | Instagram | Telegram | Threads | LinkedIn, For the Latest Technology News & Updates | Latest Electric Vehicles News | Electronics News | Mobiles News | Software Updates