The Union Budget 2026–27 marks a decisive shift in India’s economic and technology strategy, positioning the country for long-term leadership in semiconductors, cloud computing, artificial intelligence, and advanced manufacturing. Presented at a time when global supply chains are being restructured and digital infrastructure is becoming a strategic asset, the budget introduces targeted fiscal measures to strengthen domestic capability, attract global capital, and reduce India’s reliance on imports.

From expanding the India Semiconductor Mission to offering unprecedented tax certainty for global cloud providers, the government has laid out a technology-driven roadmap aligned with the vision of Viksit Bharat and Atmanirbhar Bharat.

Accelerating Energy Transition and Domestic Energy Security

Energy transition remains a central pillar of the Union Budget 2026, with a clear emphasis on renewable infrastructure and energy storage manufacturing.

To support India’s growing demand for clean energy, the government has proposed extending the basic customs duty (BCD) exemption on capital goods used in Lithium-Ion battery cell manufacturing, a measure first introduced in the previous budget. This extension is expected to significantly lower production costs for battery storage systems—an essential component for solar and wind energy scalability.

Further strengthening the solar ecosystem, the budget proposes BCD exemption on sodium antimonate, a key raw material used in the production of solar glass. This move is aimed at boosting domestic solar manufacturing while reducing dependence on imported inputs.

In the consumer appliances segment, the exemption of customs duty on specified microwave oven components aligns with the government’s broader push for value addition and localisation within India’s electronics manufacturing ecosystem.

India as a Global Cloud and Data Center Hub

One of the most consequential announcements in Union Budget 2026 is the long-term incentive framework for cloud computing and data centers—sectors that are now critical to AI, fintech, governance platforms, and digital public infrastructure.

Tax Holiday Until 2047 for Global Cloud Providers

The government has proposed tax holidays until 2047 for foreign companies offering cloud services to global customers through India-based data centers. This provides unparalleled long-term policy certainty and is expected to attract large-scale investments from hyperscalers and global SaaS providers.

By encouraging onshore data processing, the policy also aligns with India’s Digital Personal Data Protection (DPDP) Act, making compliance easier while strengthening data sovereignty.

Safe-Harbour Norms for Transfer Pricing Certainty

To reduce litigation and compliance complexity, related-party entities providing data center services from India will now qualify for a 15% safe-harbour margin on cost. This move is widely seen as a trust-based regulatory reform that simplifies transfer pricing norms and improves ease of doing business for multinational technology firms.

Ease of Living Through Customs Duty Rationalisation

In a move aimed at simplifying taxation for individuals, the budget proposes a significant reduction in customs duties on personal imports.

The tariff rate on all dutiable goods imported for personal use has been cut from 20% to 10%, streamlining the customs structure and reducing costs for consumers. This rationalisation supports the broader “Ease of Living” agenda while reducing friction in cross-border personal trade.

India Semiconductor Mission 2.0: From Assembly to Full-Stack Capability

Building on the foundation of ISM 1.0, the government has officially launched India Semiconductor Mission (ISM) 2.0, marking a shift from capacity creation to ecosystem depth.

Three Strategic Pillars of ISM 2.0

The second phase focuses on strengthening the semiconductor value chain across three critical dimensions:

Equipment and Materials Manufacturing

Encouraging domestic production of semiconductor fabrication equipment, specialty chemicals, and advanced materials.

Full-Stack IP and Chip Design

Moving India up the value chain by developing indigenous intellectual property and design capabilities, rather than limiting participation to assembly and testing.

Supply Chain Resilience

Building robust, localised supply networks to reduce exposure to global disruptions.

Industry-Led R&D and Talent Development

ISM 2.0 will also support industry-led research centres and training hubs, aimed at building proprietary technology and a highly skilled workforce capable of meeting the demands of advanced chip manufacturing and design.

Electronics Components Manufacturing Scheme Gets a Major Boost

The budget highlighted the strong industry response to the Electronics Components Manufacturing Scheme (ECMS), launched in April 2025 with an initial outlay of ₹22,919 crore.

Given that investment commitments have already exceeded original targets, the government has proposed increasing the scheme’s allocation to ₹40,000 crore. This expanded funding is expected to:

Deepen domestic component manufacturing

Reduce import dependence

Strengthen India’s electronics supply chain

Support large-scale employment generation

Strong Industry Endorsement Across Sectors

The technology and manufacturing industry has broadly welcomed the Union Budget 2026, viewing it as a shift from scale-driven growth to capability-led development.

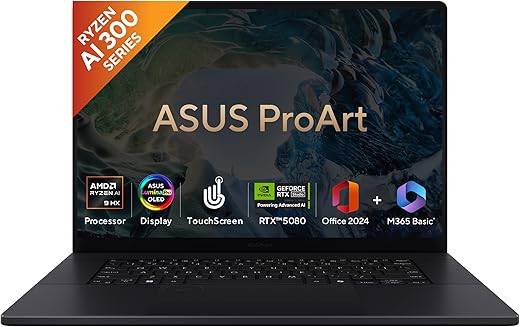

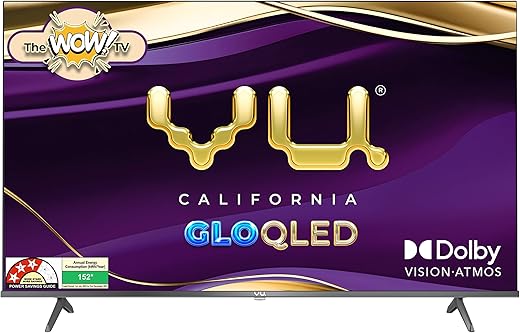

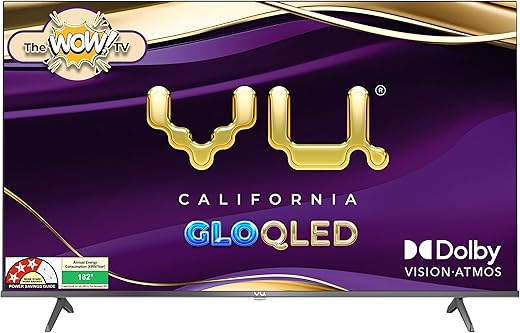

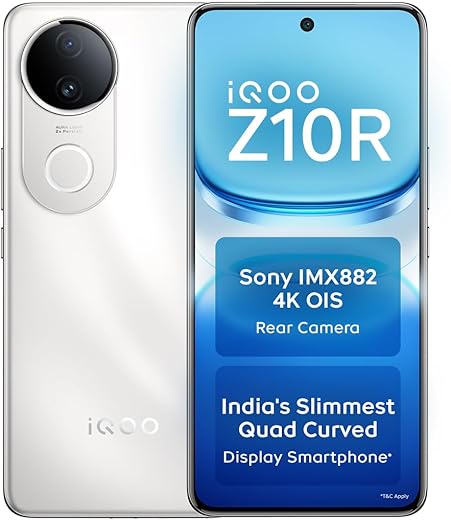

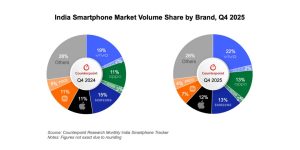

Leaders from smartphone manufacturing, consumer electronics, semiconductors, AI, cloud services, and education technology have highlighted the budget’s emphasis on long-term policy clarity, supply chain resilience, and indigenous IP creation.

Executives from companies such as TECNO, BenQ, Hisense, NXP Semiconductors, Haier, CP PLUS, and Lava International noted that the expansion of ISM 2.0 and ECMS provides the confidence needed for deeper localisation, R&D investment, and global competitiveness.

AI and cloud-focused companies including TrueReach AI, Covasant Technologies, Redacto.ai, Matters.AI, and Nxtra by Airtel highlighted the significance of tax holidays, compute infrastructure expansion, and AI mission funding in enabling India’s transition from a services hub to an “intelligence-first” economy.

Education, AI, and Workforce Readiness

Beyond manufacturing, the budget also connects technology growth with employability. Initiatives such as the Education-to-Employment Standing Committee, Content Creator Labs in schools, and industry-linked university townships aim to align education outcomes with emerging industry needs—especially in AI, semiconductors, and advanced manufacturing.

This integrated approach ensures that India’s technology ambitions are supported by a future-ready workforce.

Conclusion

Union Budget 2026 goes beyond incremental reforms and signals a structural transformation in how India approaches technology, manufacturing, and digital infrastructure.

By combining long-term tax certainty, deep investments in semiconductors and electronics, cloud-friendly policies, and workforce alignment, the government has laid a strong foundation for India to emerge as a trusted global hub for chips, cloud, and AI-driven innovation.

The real test now lies in execution—but the intent, scale, and policy clarity suggest that India’s technology growth story is entering a far more substantive and globally competitive phase.

Follow Before You Take on:

Latest Technology News | Updates | Latest Electric Vehicle News | Updates | Electronics News | Mobile News | Updates | Software Updates

📌 Facebook | 🐦 Twitter | 📢 WhatsApp Channel | 📸 Instagram | 📩 Telegram | 💬 Threads | 💼 LinkedIn | 🎥 YouTube

🔔 Stay informed, Stay Connected!