India’s smartphone market ended 2025 on a cautious note, according to the latest findings from the Worldwide Quarterly Mobile Phone Tracker published by the International Data Corporation (IDC). While overall shipments for the year rose marginally by 0.5% year-over-year (YoY) to 152 million units, the fourth quarter painted a more subdued picture.

In Q4 2025, smartphone shipments in India fell 5% YoY to 34 million units, reflecting post-festive inventory corrections and restrained consumer spending.

Q4 2025 Slowdown: Inventory Correction and Cautious Spending

IDC attributes the fourth-quarter dip primarily to post-festive inventory normalization. After aggressive sales during India’s festive season, retailers and brands focused on clearing excess stock rather than pushing fresh volumes.

At the same time, cautious consumer sentiment limited upgrade and replacement cycles. Higher device prices and macroeconomic pressures dampened discretionary spending, especially in entry-level and mid-range Android segments.

Annual Market Snapshot: 152 Million Units in 2025

Despite the weak finish, India’s smartphone shipments grew slightly for the full year, reaching 152 million units in 2025—up 0.5% YoY. The year followed a mixed pattern:

Subdued first half

Recovery during mid-year festive and promotional periods

Soft landing in Q4

The modest annual growth highlights a maturing smartphone market where replacement cycles are lengthening and value growth is becoming more important than pure volume expansion.

Apple Expands Footprint in India

Apple recorded a standout performance in 2025, shipping a record 14 million iPhones in India, reflecting 16% YoY growth.

Key highlights:

India became Apple’s fourth-largest market globally after the US, China, and Japan

Apple ranked fifth in overall unit volume with a 10% market share

Led the market by value with a 29% share

The iPhone 16 alone accounted for 4% of total smartphone shipments in India

Apple’s growth was driven by strong demand in the premium and mid-premium segments, along with increased financing options and expanded retail presence.

Rising Smartphone Prices in Q4 2025

Contrary to the typical post-festive trend of price reductions, Q4 2025 saw average selling prices (ASPs) increase 4% YoY to US$279.

For the full year:

ASPs rose 8% YoY

Reached a record US$282

IDC attributes this pricing trend to:

Rising global memory costs

Depreciation of the Indian rupee

Higher component expenses

These factors led to price hikes across both new launches and existing models, ultimately slowing demand.

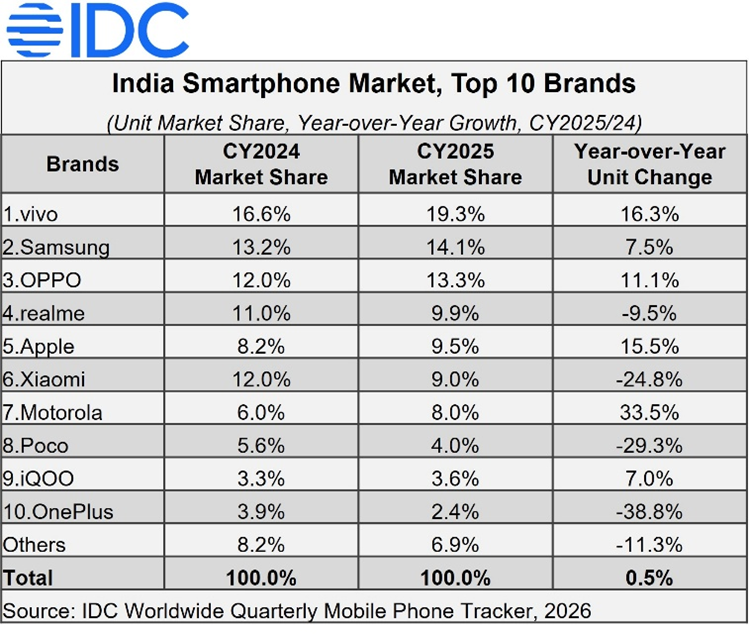

Top 10 Smartphone Brands in India (CY2025)

Market Leaders by Volume Share

Vivo – 19.3% share (16.3% growth)

Samsung – 14.1% share (7.5% growth)

OPPO – 13.3% share (11.1% growth)

Realme – 9.9% share (-9.5%)

Apple – 9.5% share (15.5% growth)

Xiaomi – 9.0% share (-24.8%)

Motorola – 8.0% share (33.5% growth)

Poco – 4.0% share (-29.3%)

iQOO – 3.6% share (7.0% growth)

OnePlus – 2.4% share (-38.8%)

Vivo retained leadership through a broad product portfolio and strong omnichannel presence. Motorola emerged as one of the fastest-growing brands, while Xiaomi and Poco experienced sharp declines.

Segment-Wise Performance in 2025

Entry-Level (Sub-US$100)

18% YoY growth

Share increased to 16%

Xiaomi and vivo led shipments

Motorola shipments surged nearly 2.4×

This segment benefited from first-time buyers and rural demand.

Mass-Budget (US$100–US$200)

Shipments declined 8% YoY

Share dropped to 41% from 44%

Vivo and OPPO gained share, with models like the vivo T4X and OPPO A5 leading shipments. However, replacement demand weakened in this segment.

Entry-Premium (US$200–US$400)

Shipments fell 5% YoY

Share reduced to 26%

Despite overall contraction, Samsung, vivo, and Motorola recorded growth. The Motorola Edge 60 Fusion was the top-performing model in this band.

Mid-Premium (US$400–US$600)

23% YoY growth

Share rose to 5%

Apple led shipments, followed by Samsung and OPPO. Popular devices included OPPO Reno 13 Pro and iPhone 13 models.

Premium (US$600–US$800)

Fastest growth: 37% YoY

Share increased to 5%

Apple dominated with a 74% share, largely driven by iPhone 16, iPhone 15, and iPhone 17 models.

Super-Premium (Above US$800)

7% YoY growth

Stable 7% market share

Apple maintained leadership with a 63% share, while Samsung expanded significantly, supported by its Galaxy S24 Ultra and S25 Ultra lineup.

Chipset Trends: Qualcomm Gains, MediaTek Slips

In 2025:

Qualcomm-based smartphone shipments grew 23% YoY

Market share increased to 30%

Meanwhile:

MediaTek shipments declined 15% YoY

Share fell from 54% to 46%

Qualcomm’s growth was largely driven by Xiaomi, OPPO, POCO, and Nothing devices.

Offline Retail Rebounds Strongly

Offline channels recorded their highest shipment levels in six years:

12% YoY growth

Share increased to 57%

Online shipments declined 12%, reducing share to 43%.

IDC credits balanced pricing strategies, improved trade margins, and premium-focused festive promotions for offline resurgence.

Outlook for 2026: Memory Shortage Concerns

IDC forecasts that India’s smartphone shipments may contract in 2026 due to an unprecedented global memory shortage.

Key expectations:

Volume decline likely

Premium demand expected to remain resilient

Finance-led purchasing to support value growth

Increased market consolidation

As pricing pressures persist, vendor scale and operational efficiency will become increasingly critical in sustaining profitability.

Conclusion

While India’s smartphone market managed marginal annual growth in 2025, the 5% YoY decline in Q4 underscores the challenges facing the industry. Rising prices, cautious consumer sentiment, and evolving upgrade cycles are reshaping demand dynamics.

At the same time, premium segments continue to expand, offline retail is regaining strength, and brands like Apple and Motorola are gaining momentum. As the market heads into 2026, supply chain constraints and memory shortages could further redefine competitive strategies in the world’s second-largest smartphone market.

Source @ idc

Follow Before You Take on:

Latest Technology News | Updates | Latest Electric Vehicle News | Updates | Electronics News | Mobile News | Updates | Software Updates

📌 Facebook | 🐦 Twitter | 📢 WhatsApp Channel | 📸 Instagram | 📩 Telegram | 💬 Threads | 💼 LinkedIn | 🎥 YouTube

🔔 Stay informed, Stay Connected!