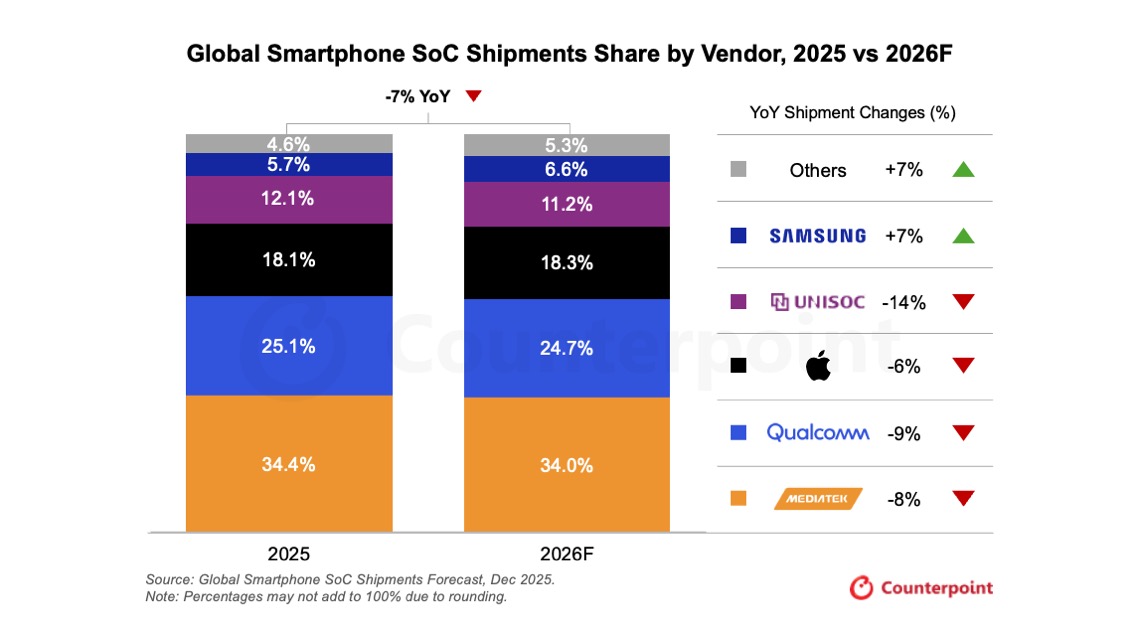

The global smartphone System-on-Chip (SoC) market is entering a transitional phase in 2026. According to Counterpoint Research’s Global Smartphone SoC Model Shipments and Revenue Tracker, Q4 2025 (Preliminary View), worldwide smartphone SoC shipments are projected to decline by 7% year-on-year (YoY). This marks a slowdown after multiple years of steady growth, driven by rising component costs, supply-side constraints, and evolving market priorities.

Despite the expected dip in shipment volumes, the market’s overall revenue outlook remains positive, supported by premiumization, advanced manufacturing nodes, and the rapid adoption of artificial intelligence (AI) features in smartphones.

Rising Memory Prices Create Pressure on Entry-Level Smartphones

One of the biggest challenges facing the smartphone SoC ecosystem in 2026 is the sharp rise in memory prices. This trend is particularly impactful for smartphones priced below $150, where margins are already thin.

Memory manufacturers and foundries are increasingly prioritizing high-margin High Bandwidth Memory (HBM) production for data centers and AI infrastructure. As a result, supply constraints and higher prices for traditional mobile memory components are expected to ripple across the smartphone supply chain.

Key Market Pressures Identified by Counterpoint

Rising memory costs impacting affordable smartphones

Supply limitations due to increased focus on data center-grade HBM

Greater pressure on vendors serving 4G and entry-level 5G devices

Reduced flexibility for OEMs operating in price-sensitive segments

SoC vendors with heavy exposure to low-cost 4G and entry-level 5G smartphones are likely to feel the strongest impact, as OEMs struggle to balance performance, memory capacity, and pricing.

Brands with In-House SoCs Better Positioned

According to Counterpoint Senior Analyst Shivani Parashar, smartphone brands that develop their own SoCs are better equipped to manage cost pressures and supply volatility. Companies such as Samsung, Google, HUAWEI, and Xiaomi benefit from tighter hardware-software integration and greater control over component optimization.

Parashar also highlights a broader industry shift toward higher-priced devices, noting that nearly one in three smartphones is expected to be priced above $500, reflecting continued demand for premium performance, camera capabilities, and AI-driven features.

Premiumization Drives Revenue Growth Despite Lower Shipments

While overall SoC shipments are forecast to decline, revenue growth is expected to remain resilient in 2026. This divergence is largely driven by ongoing premiumization across the global smartphone market.

OEMs are increasingly:

Streamlining product portfolios

Reducing low-margin SKUs

Making strategic trade-offs in memory and hardware configurations

Exploring cloud offloading for AI workloads to manage on-device costs

Counterpoint suggests that a short-term recovery in overall smartphone shipments is unlikely before 2027, as brands focus on profitability rather than volume growth.

Transition from 3nm to 2nm Marks a New Technology Era

The smartphone SoC market is also undergoing a major technological transition. Premium SoC manufacturers are preparing to move from 3nm to 2nm process nodes, enabling better performance, power efficiency, and AI processing capabilities.

Key Developments in 2nm SoC Adoption

Samsung announced the Exynos 2600 in December 2025, the world’s first 2nm smartphone SoC

Leading premium chipset players are planning 2nm adoption for next-generation flagships

Samsung is expected to align the 2nm transition with the Galaxy S26 series

According to Counterpoint Senior Analyst Soumen Mandal, this shift will play a crucial role in sustaining double-digit revenue growth in 2026, even as shipment volumes soften.

Competitive Landscape: Apple, Qualcomm, and MediaTek

The competitive dynamics of the smartphone SoC market are also evolving. Apple and Qualcomm are expected to benefit the most from premiumization, as both companies maintain strong positions in high-end smartphones.

Meanwhile, MediaTek continues to expand its footprint in the Android ecosystem, intensifying competition across mid-range and premium tiers. Samsung is gradually increasing the adoption of its in-house Exynos chips in premium devices, supported by advancements in manufacturing technology.

AI Integration Becomes a Key Growth Driver

Artificial intelligence is emerging as a major catalyst for higher SoC value and device pricing. The rollout of generative AI features is pushing smartphone average selling prices (ASPs) upward, especially in premium segments.

AI Performance and Adoption Trends

Peak on-device AI performance expected to reach around 100 TOPS by 2026

Nearly 90% of premium smartphones likely to support on-device AI

Mid-range devices ($100–$500) expected to rely more on cloud-based AI due to memory and cost constraints

This hybrid approach allows OEMs to deliver AI features without significantly increasing bill-of-materials costs in price-sensitive segments.

Outlook:

Counterpoint Research expects 2026 to be a transitional year for the global smartphone SoC market. While shipment volumes are set to decline due to memory pricing pressures and cautious OEM strategies, revenue growth is likely to remain strong.

Premiumization, AI feature adoption, and the transition to advanced 2nm process nodes are reshaping the market toward higher-value devices. Although a full recovery in shipment growth may not occur until 2027, the industry’s focus on performance, efficiency, and AI capabilities is expected to support long-term profitability.

Follow Before You Take on:

Latest Technology News | Updates | Latest Electric Vehicle News | Updates | Electronics News | Mobile News | Updates | Software Updates

📌 Facebook | 🐦 Twitter | 📢 WhatsApp Channel | 📸 Instagram | 📩 Telegram | 💬 Threads | 💼 LinkedIn | 🎥 YouTube

🔔 Stay informed, Stay Connected!