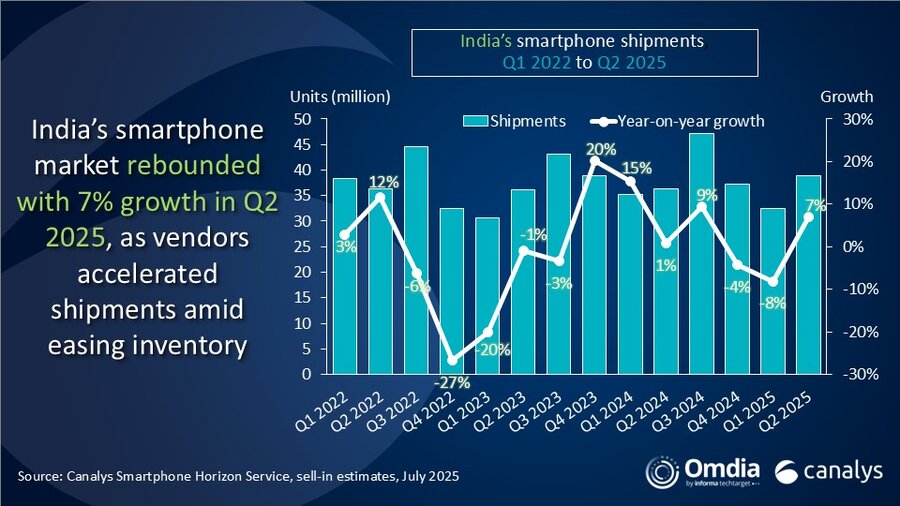

India’s smartphone industry has shown a strong recovery in Q2 2025, with shipments reaching 39 million units—marking a 7% year-on-year (YoY) growth, according to a report by Canalys, now under the Omdia umbrella. This uptick comes after a cautious Q1, supported by easing inventory issues and a renewed focus on aggressive vendor-led strategies.

Key Highlights

Smartphone shipments in India reached 39 million in Q2 2025

7% YoY growth from Q2 2024

Vivo led the market with 8.1 million units shipped

OPPO overtook Xiaomi in rankings

Realme, Apple, Motorola, and Nothing saw notable market movements

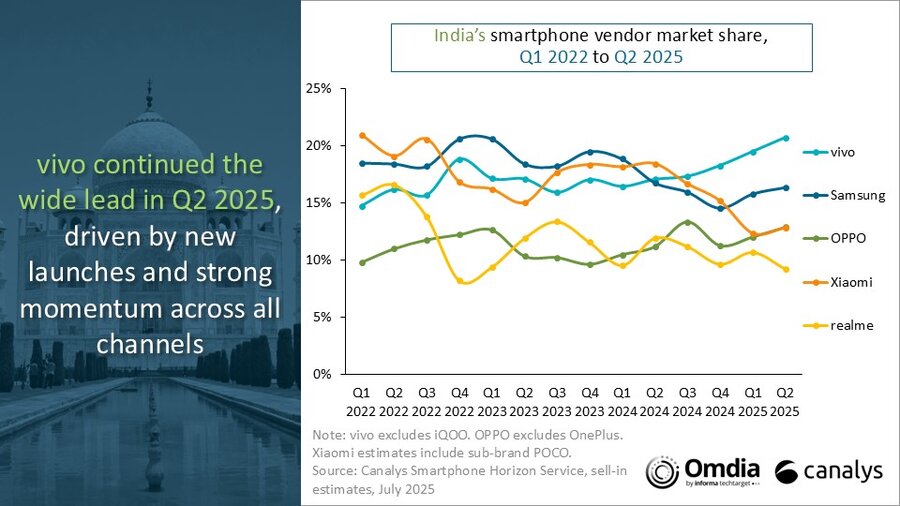

Top Vendors: Vivo Takes the Lead

Vivo led the Indian smartphone market in Q2 2025, excluding iQOO, with 8.1 million units shipped, accounting for a 21% market share. Its performance was driven by the success of its V50 series in major cities and a strong showing of the Y-series in smaller towns.

Samsung followed closely with 6.2 million units and a 16% market share. OPPO climbed the ranks with five million units shipped, narrowly surpassing Xiaomi. realme rounded out the top five with 3.6 million units.

What Worked for Vivo and OPPO?

Vivo focused on offline reach and aggressive marketing:

V50 lineup gained traction in metro and tier-2 markets

Y-series sustained momentum in rural and smaller towns

T-series strengthened online presence with new variants

OPPO’s gains came through:

Offline retail push for A5 series

Rising online interest in the K13 model

Focused Push from Samsung, Xiaomi, and realme

Samsung bet big on mid-range smartphones by offering zero-interest EMIs up to 24 months on models like the Galaxy A36 and A56. Xiaomi, despite a YoY decline, experienced quarterly growth by pushing refreshed versions of the Redmi 14C 5G and Note 14 series.

realme saw an overall decline but made notable offline progress with the C73, C75, and 14X, which together accounted for 35% of its shipments.

Growth Beyond the Top Five

Other brands also witnessed notable changes:

Apple:

Retained sixth place, with over 55% of its shipments coming from the iPhone 16 lineup. The iPhone 16e saw a slower response.

motorola:

Expanded offline presence in smaller cities after growth in metro regions.

Infinix:

Became TRANSSION’s leading brand in India, accounting for 45% of TRANSSION’s 1.8 million units. Success was fueled by bold designs and youth-focused marketing.

Nothing:

Posted an impressive 229% YoY growth driven by premium, design-forward phones like the CMF Phone 2 Pro and Phone 3a Pro.

Outlook: H2 2025 Hinges on Retail Strength and Affordability

The second half of 2025 is expected to prioritize distribution execution over product launches. Brands are ramping up their retail and promotional efforts:

High-value incentives such as cars and international trips are being used to motivate channel partners during key festivals.

Retail displays are being upgraded with improved experiences and stricter promoter performance goals.

Mid-to-premium smartphone segments are receiving enhanced financing options to improve affordability.

Despite all these efforts, Canalys predicts a marginal decline in overall 2025 shipments due to structural issues still affecting consumer demand.

Conclusion

India’s smartphone market in Q2 2025 reflects signs of a rebound, led by strategic launches, retail execution, and vendor promotions. While the near-term looks promising, sustainable growth will depend on affordability innovations, effective retail partnerships, and economic recovery.

Follow Before You Take on:

Latest Technology News | Updates | Latest Electric Vehicle News | Updates | Electronics News | Mobile News | Updates | Software Updates

📌 Facebook | 🐦 Twitter | 📢 WhatsApp Channel | 📸 Instagram | 📩 Telegram | 💬 Threads | 💼 LinkedIn | 🎥 YouTube

🔔 Stay informed, Stay Connected!