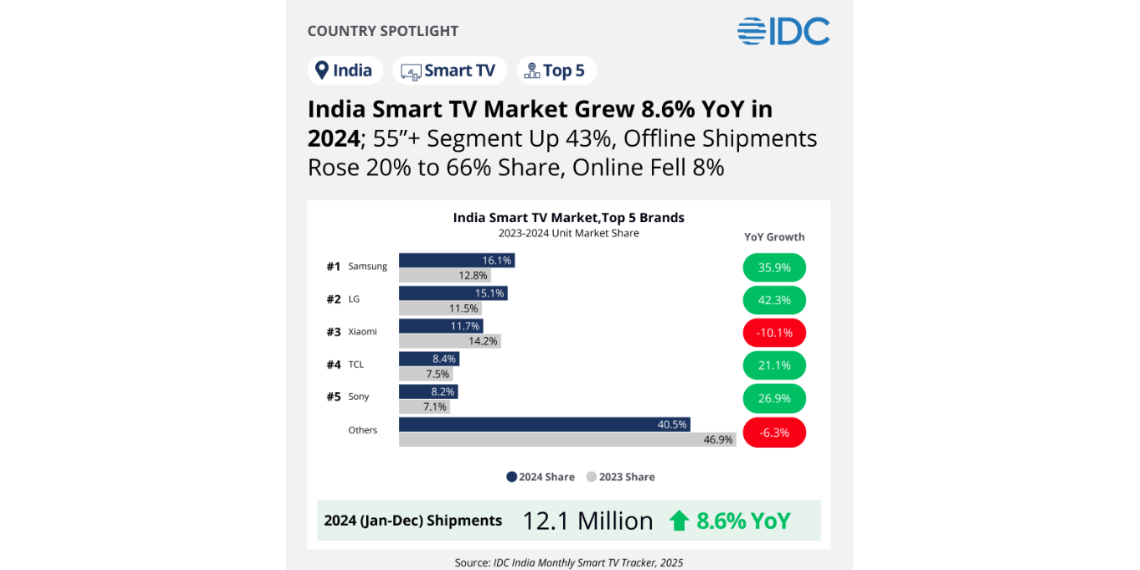

The Indian smart TV market witnessed notable growth in 2024, registering an 8.6% year-on-year (YoY) increase with 12.1 million units shipped, according to data from the International Data Corporation (IDC). This surge was largely driven by increased consumer demand for larger screen sizes, especially in the 55-inch and above segment, and growing preference for offline retail channels. While Samsung retained its top spot, other brands such as LG, TCL, and Sony also recorded impressive growth, whereas Xiaomi slipped from its earlier position.

Key Highlights

Market grew by 8.6% YoY in 2024 with 12.1 million units shipped.

Samsung led the market with 16.1% share and 35.9% YoY growth.

LG climbed to second place, growing 42.2% YoY with a 15.1% share.

Xiaomi slipped to third, losing 10.1% YoY and dropping to 11.7% share.

TCL and Sony recorded strong growth, while overall market consolidation increased.

2025 started slow, with a 7% YoY decline in shipments during Jan-Feb.

Offline channel dominance rose, taking 66% of the market as online dipped.

Market Overview: Bigger Screens, Shifting Channels

One of the standout trends in 2024 was the significant 43% YoY growth in the 55-inch and above smart TV segment. This indicates a growing appetite among Indian consumers for immersive, cinema-like viewing experiences at home.

Moreover, the sales channel dynamics witnessed a shift. Offline shipments rose by 20%, pushing offline’s overall market share to 66%. Meanwhile, online sales declined by 8%, suggesting consumer trust in physical retail stores is strengthening again, likely due to value-added services such as demos and immediate delivery.

Brand-Wise Market Performance

Samsung – Market Leader

Samsung led the pack with a 16.1% market share, up from 13.4% in 2023. The brand achieved 35.9% YoY growth, benefiting from its expansive range of smart TVs across QLED, OLED, and Frame series. Strategic pricing and strong offline presence contributed to its leadership.

LG – Gaining Momentum

LG claimed the second position with a 15.1% share, up from 11.5% in the previous year. Its 42.2% YoY growth highlights effective execution in premium and mid-range categories. The brand’s OLED offerings and innovations in picture and audio technology boosted its appeal.

Xiaomi – Losing Ground

Xiaomi, which had previously dominated the Indian smart TV market, slipped to third place with an 11.7% market share, down from 14.2% in 2023. The company experienced a 10.1% YoY decline, possibly due to increased competition and reduced differentiation in its product lineup.

TCL – Gradual Growth

TCL improved its market position with an 8.4% share, up from 7.5% the previous year. The brand’s 21.1% YoY growth was aided by aggressive pricing, partnerships with e-commerce platforms, and steady retail expansion.

Sony – Premium Appeal

Sony ranked fifth with an 8.2% market share, witnessing a 26.9% YoY growth. Known for its premium Bravia line and strong brand loyalty, Sony continues to appeal to high-end customers seeking superior visual and sound quality.

Others – Market Consolidation in Progress

All other brands collectively accounted for 40.5% market share, down from 46.9% in 2023. This 6.3% YoY decline reflects growing consolidation, where dominant players are capturing more of the market share.

Slow Start to 2025, but Outlook Remains Positive

The Indian smart TV market reportedly started 2025 on a cautious note, with a 7% YoY dip in shipments during January-February, attributed to high inventory and weak consumer sentiment during the period. However, IDC anticipates a rebound in the coming quarters, supported by new product launches and festive demand.

Brands like Samsung and Xiaomi have already rolled out new QLED, OLED, and smart TV models in early 2025, aiming to capture emerging demand trends and re-engage customers with enhanced features and competitive pricing.

Conclusion

India’s smart TV market showed healthy growth in 2024 despite facing macroeconomic challenges and rising competition. Samsung’s leadership and LG’s upward momentum underscore the importance of innovation and multi-channel strategies. While Xiaomi’s slip serves as a cautionary tale, the continued expansion of brands like TCL and Sony shows that both affordability and premium positioning can coexist successfully.

With promising new launches and shifting consumer preferences, the Indian smart TV market is poised for further evolution and potential recovery in the latter half of 2025.

Follow Before You Take on:

Latest Technology News | Updates | Latest Electric Vehicle News | Updates | Electronics News | Mobile News | Updates | Software Updates

📌 Facebook | 🐦 Twitter | 📢 WhatsApp Channel | 📸 Instagram | 📩 Telegram | 💬 Threads | 💼 LinkedIn | 🎥 YouTube

🔔 Stay informed, Stay Connected!