The Indian smartphone market witnessed a dramatic transformation in 2025, driven by the rapid mainstream adoption of 5G technology. According to CyberMedia Research’s (CMR) India Mobile Handset Market Review for Calendar Year 2025 (CY2025), shipments of budget 5G smartphones surged by over 1900% year-on-year, marking one of the most significant shifts in India’s mobile landscape.

While the overall smartphone market recorded a marginal 1% YoY decline, the data highlights a deeper structural transition—one defined by the democratization of 5G, evolving consumer preferences, and a clear polarization between entry-level and premium segments.

Indian Smartphone Market in 2025: A Phase of Structural Transition

Despite flat overall volumes, CY2025 was far from stagnant for the Indian smartphone industry. Instead, the market entered a phase of recalibration, where consumer demand became sharply divided.

On one end, affordable 5G smartphones experienced explosive growth, making next-generation connectivity accessible to first-time buyers. On the other, the premium and ultra-premium segments continued to expand, supported by brand loyalty, financing options, and feature-driven upgrades.

This dual-speed market underscores India’s growing maturity as one of the world’s most competitive smartphone ecosystems.

The Democratization of 5G in India

The standout story of CY2025 was the mass adoption of 5G technology. Once limited to high-end devices, 5G has now become the default choice for Indian consumers.

5G Becomes the Market Standard

5G smartphones accounted for 88% of total shipments in 2025

This marked a 12% increase YoY, reinforcing the shift away from 4G-only devices

5G is no longer a premium feature but an expected baseline

Budget Segment Fuels Explosive Growth

The most remarkable expansion came from the INR 6,000–8,000 price segment, where 5G smartphone shipments surged by over 1900% YoY.

Key drivers behind this surge included:

Aggressive pricing strategies by smartphone brands

Increased availability of entry-level 5G chipsets

Completion of pan-India 5G network rollout

Growing awareness and demand for future-ready devices

This shift has fundamentally changed the entry-level smartphone category, accelerating upgrades among price-sensitive users.

Evolving Consumer Preferences: Bigger Displays and Bigger Batteries

Indian consumers in 2025 showed clear and consistent preferences when it came to hardware design, largely shaped by content consumption and extended daily usage.

Large Displays Dominate Shipments

Smartphones with 6.7-inch or larger displays accounted for nearly 80% of total shipments

Large screens have become standard, even in budget devices

The trend reflects increased video streaming, gaming, and social media usage

Battery Life Takes Center Stage

Almost one in three smartphones shipped with a 6,000mAh or larger battery

Users increasingly prioritize multi-day battery life over slimmer designs

This trend aligns closely with the rise of 5G usage, which demands higher power efficiency

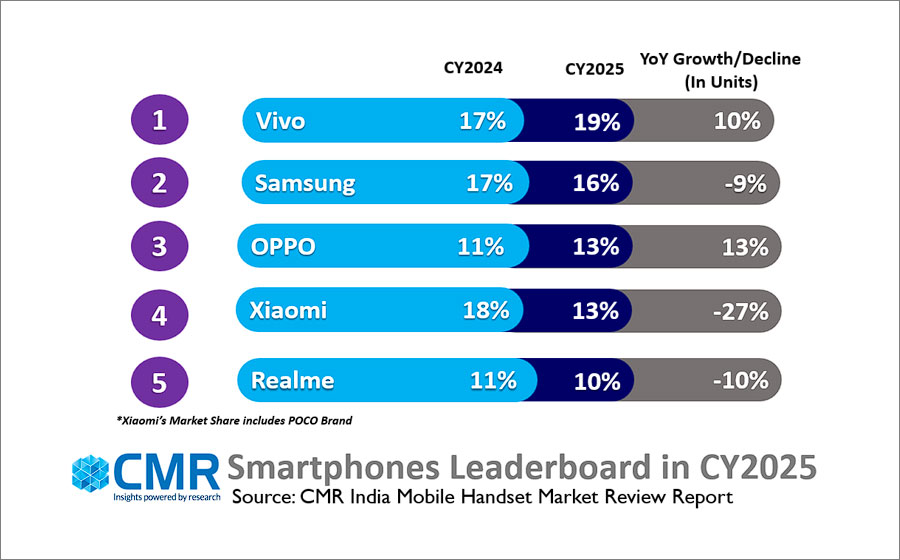

Competitive Landscape: Market Leaders in CY2025

The competitive hierarchy in India saw notable shifts, with brands adjusting strategies to capture both mass-market and premium opportunities.

Vivo Leads the Indian Smartphone Market

Vivo emerged as the market leader in CY2025, capturing 19% market share.

Also led the 5G segment with 19% share

Strong execution in the mass market

Models such as T4X, Y19, Y29, and Y39 contributed 34% of Vivo’s total 5G shipments

Samsung Holds Strong in Premium Growth

Samsung retained the second position with 16% market share.

Overall volumes remained steady

The ultra-premium segment (above INR 1,00,000) grew by 45% YoY

Growth driven by Galaxy S and Galaxy Z foldable series

OPPO Registers Positive Momentum

OPPO secured 13% market share, supported by 13% YoY growth.

Balanced portfolio across price bands

Strong traction from value-focused models like A3X and A5 Pro

Continued appeal among premium consumers

Xiaomi Faces Market Pressure

Xiaomi also held 13% market share but recorded a 27% YoY decline.

Intensified competition in the premium segment

Shifting consumer expectations and brand positioning challenges

Indicates the growing difficulty of sustaining scale without portfolio differentiation

Premium and Niche Growth Stories

Beyond the top four brands, several players delivered notable performance through focused strategies.

Apple Expands Its Indian Footprint

Apple recorded 25% YoY growth, capturing approximately 9% market share.

The base iPhone 16 emerged as a key growth driver

Accounted for 47% of total iPhone 16 series volumes

Reflects a strong preference for value-oriented flagship models over Pro variants

Fastest-Growing Smartphone Brands

iQOO: +81% YoY growth

CMF: +78% YoY growth

Motorola: +50% YoY growth

These brands benefited from:

Competitive offerings in the INR 50,000–1,00,000 super-premium segment

Aggressive online and offline channel expansion

Clear performance and design-led positioning

Lava Stays Resilient

Lava grew by 8% YoY, standing out in an otherwise flat market.

Steady demand in the affordable segment

Continued appeal as a value-focused domestic brand

OnePlus Navigates a Challenging Year

OnePlus experienced a 32% YoY decline, yet maintained volume through its Nord series, which accounted for 67% of shipments.

Early traction observed for the new OnePlus 13 and 15 series

Signals potential recovery in upcoming cycles

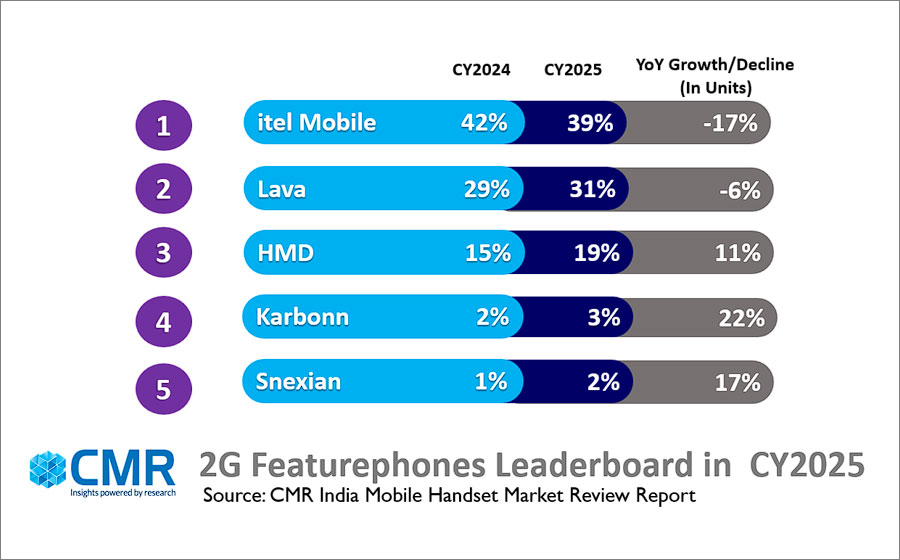

Feature Phone Market and Chipset Landscape

Feature Phone Segment Continues to Decline

The feature phone market contracted sharply in 2025:

2G feature phones declined by 12%

4G feature phones dropped by 48%

The 2G segment remains consolidated, led by:

Itel (39%)

Lava (31%)

HMD (19%)

Chipset Market: MediaTek vs Qualcomm

MediaTek dominated the overall chipset market with 45% share

Qualcomm retained leadership in the premium segment (above INR 25,000) with a 34% share

This split reflects MediaTek’s strength in affordable 5G and Qualcomm’s premium positioning

Future Outlook: What to Expect in 2026

Looking ahead, CMR forecasts a single-digit decline in smartphone shipments for CY2026. However, the outlook remains cautiously optimistic.

Pricing pressures are expected to ease over the year

Demand recovery is likely as consumer confidence stabilizes

Affordable 5G devices will continue to drive volume

Premium and super-premium segments are expected to remain resilient

Conclusion

CY2025 marked a turning point for India’s smartphone market. The 1900% YoY surge in budget 5G smartphone shipments highlights how quickly advanced technology has become accessible to the masses. With 5G now firmly established as the default standard, the industry is entering a new phase—one defined by affordability, performance, and long-term value.

As brands recalibrate their strategies and consumers continue to upgrade, India’s smartphone market is set to evolve further, balancing mass adoption with premium innovation.

Follow Before You Take on:

Latest Technology News | Updates | Latest Electric Vehicle News | Updates | Electronics News | Mobile News | Updates | Software Updates

📌 Facebook | 🐦 Twitter | 📢 WhatsApp Channel | 📸 Instagram | 📩 Telegram | 💬 Threads | 💼 LinkedIn | 🎥 YouTube

🔔 Stay informed, Stay Connected!