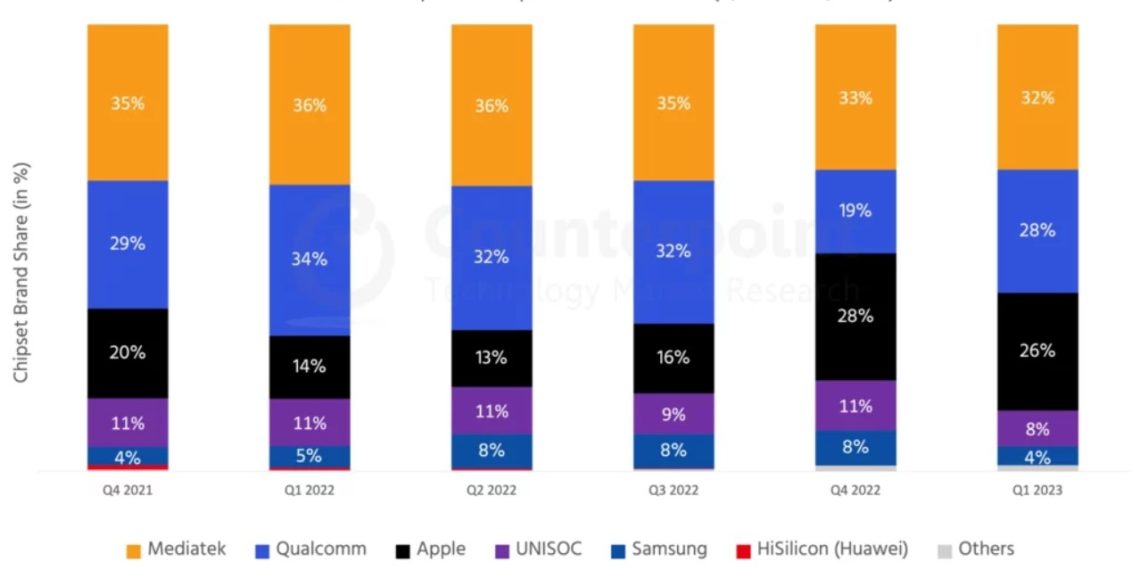

The smartphone application processor (AP) market has witnessed significant developments in recent months, according to the latest report by Counterpoint Research. The report, covering the period from Q4 2021 to Q1 2023, provides valuable insights into the dynamics of the industry. In Q1 2023, MediaTek emerged as the market leader in smartphone processors, although it experienced a slight decline compared to the previous quarter. This article delves into the report’s findings, analyzing the performances of key players such as MediaTek, Qualcomm, Apple, UNISOC, Samsung, and Huawei Hisilicon. It also discusses the potential implications of these developments for the smartphone industry as a whole.

MediaTek’s Market Share and Outlook

During Q1 2023, MediaTek secured a 31% market share in the smartphone AP market, solidifying its position as the leading player. However, the company experienced a decline in both shipments and market share compared to the previous quarter. This decline can be attributed to inventory adjustments and weakened demand, resulting in a projected decline of over 5% in LTE SoC shipments and less than 5% growth in 5G SoC shipments for Q2 2023. Analysts expect MediaTek to bounce back in the second half of the year as inventory levels stabilize and demand picks up.

Qualcomm’s Performance and Expectations

Qualcomm, a prominent player in the AP market, captured a 28% market share in Q1 2023, positioning itself as a close second to MediaTek. Although Qualcomm’s shipments are projected to remain flat in Q2 2023 due to inventory reductions, industry experts anticipate a return to normalcy in the coming quarters.

Apple’s Resilience and Seasonal Decline

Renowned for its proprietary chipsets, Apple held a 26% market share in Q1 2023. However, the company is expected to experience a decline in chipset shipments in Q2 2023 due to seasonality. Despite this, iOS outperformed the Android market and demonstrated resilience against weak demand.

Samsung’s Growth and Product Lineup

Samsung witnessed a slight increase in shipments during Q1 2023, thanks to the successful launch of its Exynos 1330 and 1380 chipsets. These offerings catered to both the high-end and low-end market segments, leading to improved sales for the company.

UNISOC’s Marginal Growth in the Low-End Segment

Specializing in the low-end segment, UNISOC experienced a marginal increase in shipments during Q2 2023. The growing demand for its LTE portfolio in devices priced below $99 contributed to this growth.

Huawei hisilicon’s Potential Comeback

Despite currently holding less than 1% market share, Huawei Hisilicon is expected to make a comeback with the launch of a new mobile phone chip in the near future. Counterpoint analysts project shipment volumes of around 2-4 million units for Huawei Hisilicon in 2023, with a focus on the mid-range segment.

OPPO’s Impact on MediaTek and Qualcomm

Counterpoint analysts highlighted the positive implications of OPPO’s decision to abandon its chip development plans. This move reduces competition for both MediaTek and Qualcomm and opens up new collaborative possibilities. With the anticipated rebound of MediaTek, the potential entry of new players, and ongoing developments in the market, the smartphone AP industry is poised for exciting advancements in the near future.

In summary, MediaTek has emerged as the dominant force in the smartphone processor market, closely followed by Qualcomm. The performance of other key players, such as Apple, Samsung, UNISOC, and Huawei Hisilicon, further adds to the evolving landscape of the industry. These developments promise intriguing progress and innovation in the realm of smartphone APs.