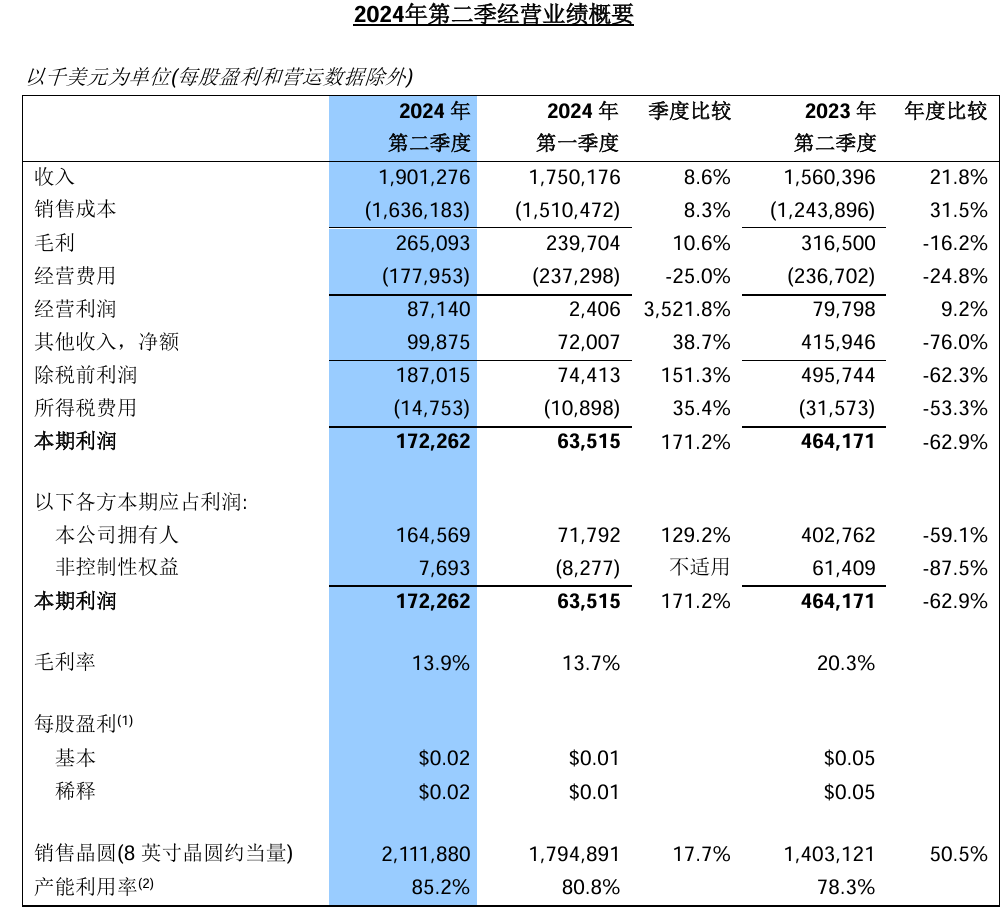

SMIC, China’s leading semiconductor foundry, has announced its financial results for Q2 2024, showcasing a remarkable performance with significant increases in both revenue and net profit. Here’s a detailed look at the key financial metrics and operational highlights for the quarter.

@gizmochina

Key Points:

Revenue: SMIC achieved $1.9013 billion (approximately RMB 13.635 billion) in sales revenue for Q2 2024. This represents an 8.6% increase from the previous month and a substantial 21.8% rise compared to the same quarter last year.

Gross Profit Margin: The company’s gross profit margin for the quarter stood at 13.9%.

Net Profit: SMIC reported a net profit of $164.6 million (about RMB 1.18 billion), marking a 129.2% month-on-month increase but a 59.1% year-on-year decrease.

Revenue Breakdown:

Consumer Electronics: 36.5%

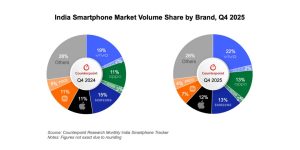

Smartphones: 32%

PCs and Tablets: 13.3%

Internet and Wearables: 11%

Industry and Automobiles: 8.1%

Geographic Revenue Distribution:

China: 80.3% of total revenue

United States: 16%

Eurasia: 3.7%

Operational Highlights:

Wafer Size and Production:

12-inch wafers contributed 73.6% to revenue.

8-inch wafers accounted for 26.4%.

Monthly production increased from 814,500 8-inch equivalent wafers in Q1 to 837,000 in Q2.

Capacity Utilization: The rate improved to 85.2%, with 2.11188 million 8-inch equivalent wafers sold, reflecting a 17.7% month-on-month increase and a 50.5% year-on-year rise.

Capital Expenditure: SMIC’s capital expenditure reached $2.2515 billion, slightly up from $2.2354 billion in Q1 2024, underscoring its ongoing investment in expanding production capabilities.

Conclusion

SMIC’s Q2 2024 financial results illustrate a robust growth trajectory and operational strength, despite some challenges. The significant increases in revenue and production capacity, coupled with a higher capacity utilization rate, highlight the company’s successful strategies and market expansion efforts. As SMIC continues to invest in technology and production, it is well-positioned for continued growth and dominance in the semiconductor industry.

Follow Before You Take on Facebook | Twitter | WhatsApp Channel | Instagram | Telegram | Threads | LinkedIn, For the Latest Technology News & Updates | Latest Electric Vehicles News | Electronics News | Mobiles News | Software Updates