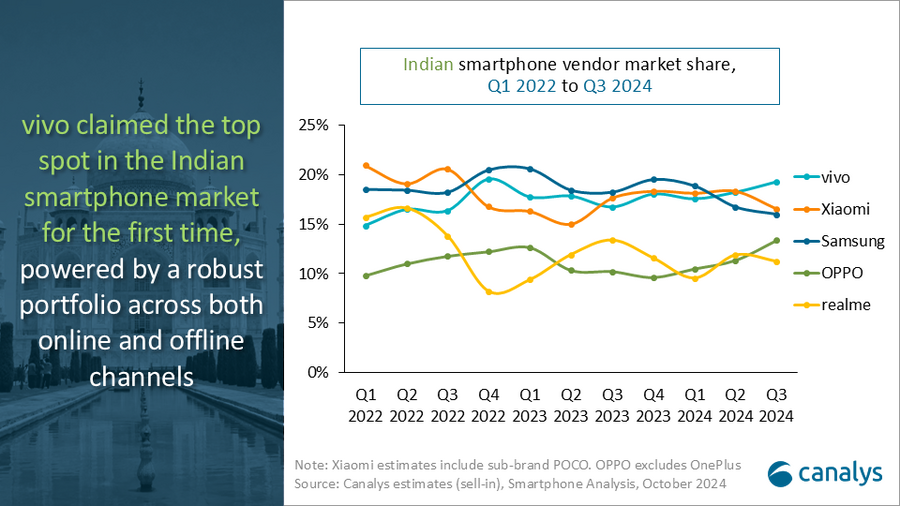

The Indian smartphone market experienced a notable resurgence in Q3 2024, recording a growth of 9% compared to the previous year. According to a recent report from Canalys, a total of 47.1 million units were shipped during this period. Vivo emerged as the frontrunner, claiming the top spot in the competitive landscape.

Key Points

Vivo Secures Leading Position: With a 19% market share and a remarkable 26% annual growth, Vivo outperformed its competitors.

Xiaomi and Samsung’s Standing: Xiaomi followed in second place with a 17% market share, while Samsung ranked third with a 16% share, despite experiencing a 4% decline in annual growth.

OPPO’s Growth Surge: OPPO witnessed an impressive 43% annual growth, marking it as the fastest-growing brand among the top five.

Emerging Trends: Consumer demand shifted towards higher-priced models due to competitive financing options and a broader mid-to-high-end offering.

Market Dynamics: The report highlights the impact of early monsoon sales on inventory clearance, aimed at preparing for the upcoming festive season.

Vivo’s Success Factors

Vivo’s success in Q3 2024 can be attributed to several strategic moves, including the launch of new devices in higher price segments. The brand also adopted aggressive channel margins to enhance its reach. Sanyam Chaurasia, a senior analyst at Canalys, noted that both Vivo and OPPO expanded their online portfolios, which significantly contributed to their market growth.

Samsung and Xiaomi’s Performance

Xiaomi, despite securing the second position, only achieved a modest 3% growth, indicating potential challenges in capturing market share. Samsung, while maintaining its position, faced a decline, signaling a need for innovative strategies to remain competitive.

OPPO’s Remarkable Growth

Among the top brands, OPPO stood out with a staggering 43% growth, driven by its robust product lineup, which includes the Vivo T3 and OPPO K12 series. These models have helped the brand penetrate both online and offline markets effectively.

Apple’s Influence

While Apple is not in the top five, it significantly impacted the market with the launch of the iPhone 15. Demand surged in smaller cities, reflecting a shift in consumer preferences toward premium devices.

Future Outlook

Looking ahead, Canalys anticipates major launches of sub-Rs 10,000 5G devices in 2025. This shift is expected to be driven by component vendors and OEMs, with an emphasis on expanding accessibility. Despite challenges, the Indian smartphone market is poised for modest single-digit growth as the pandemic-driven replacement cycle comes to an end.

Conclusion

The Indian smartphone market’s growth in Q3 2024 underscores the dynamic nature of the industry, driven by strategic launches, competitive pricing, and evolving consumer preferences. As brands like Vivo and OPPO continue to innovate and expand their offerings, the landscape is set for further developments in the coming years.

Follow Before You Take on Facebook | Twitter | WhatsApp Channel | Instagram | Telegram | Threads | LinkedIn, For the Latest Technology News & Updates | Latest Electric Vehicles News | Electronics News | Mobiles News | Software Updates