Razorpay, a leading fintech startup in India, has unveiled its latest offering, Turbo UPI, in collaboration with Axis Bank and the National Payments Corporation of India (NPCI). Turbo UPI is a groundbreaking product designed to transform the UPI payment landscape, providing users and businesses with a host of benefits that enhance speed, reliability, and user experience.

Enhanced Speed and Reduced Payment Failures

Turbo UPI leverages advanced technology and strategic partnerships to make UPI payments faster and more efficient. By streamlining the payment process, Turbo UPI significantly reduces potential payment failures that can often frustrate users and impede transactions. This translates to a seamless payment experience for both customers and businesses, fostering trust and improving overall efficiency.

Integrated Payment Solution for Merchants

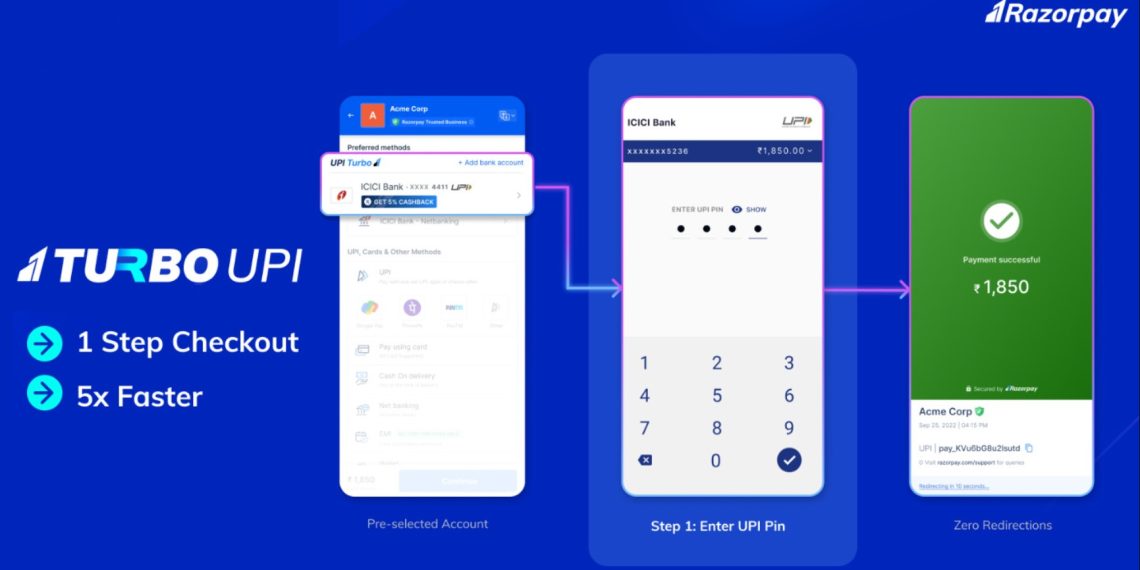

One of the key advantages of Turbo UPI is the ability for merchants to integrate it directly into their payment gateways. This eliminates the need for customers to navigate third-party UPI payment apps, enabling them to make payments seamlessly from their UPI-linked bank accounts within the merchant app itself. The integration of Turbo UPI empowers businesses with greater control over the payment process, enhancing user experience and boosting customer satisfaction.

Improved Success Rate for UPI Payments

Razorpay claims that Turbo UPI can help businesses achieve nearly a 10% increase in the success rate of UPI payments. By leveraging advanced technology and close collaboration with Axis Bank and NPCI, Turbo UPI ensures that transactions are executed smoothly and efficiently, minimizing errors and maximizing successful payments. This enhanced success rate translates to improved cash flow for businesses and a more seamless payment experience for customers.

Swift and Seamless Payment Experience

Turbo UPI promises a two-step payment experience for end-users, making transactions faster and more convenient. By reducing the number of steps required to complete a payment, Turbo UPI streamlines the process and saves users valuable time. The enhanced efficiency and speed of Turbo UPI offer users a more intuitive and hassle-free payment experience, fostering greater trust and encouraging increased adoption of digital payments.

Early Adoption and Future Prospects Although

Turbo UPI is currently in the pilot stage, it has already garnered interest from prominent apps such as Tata StarQuik, Ixigo, FNP (Ferns N Petals), Trainman, and Dhan. These companies are eager to embrace this innovative payment solution and provide their customers with an optimized payment experience. As Turbo UPI gains momentum and popularity, more businesses are expected to join the platform, further expanding its reach and impact.

The Rise of Platform-Specific UPI Solutions

Platform-specific UPI payment solutions have become increasingly popular among digital merchants due to their ability to provide a seamless and tailored payment experience. Recognizing this trend, Razorpay’s Turbo UPI aims to empower businesses to build their own UPI payment solutions, enabling them to offer a customized and frictionless payment process to their customers. This shift towards platform-specific UPI solutions allows businesses to have greater control over the payment journey, ensuring a smoother and more reliable experience.

Razorpay’s Turbo UPI is set to redefine the UPI payment landscape, offering users and businesses an advanced and streamlined payment solution. With its focus on speed, reliability, and user experience, Turbo UPI has the potential to revolutionize digital payments in India. Stay tuned for further updates as Razorpay continues to innovate and shape the future of UPI payments.