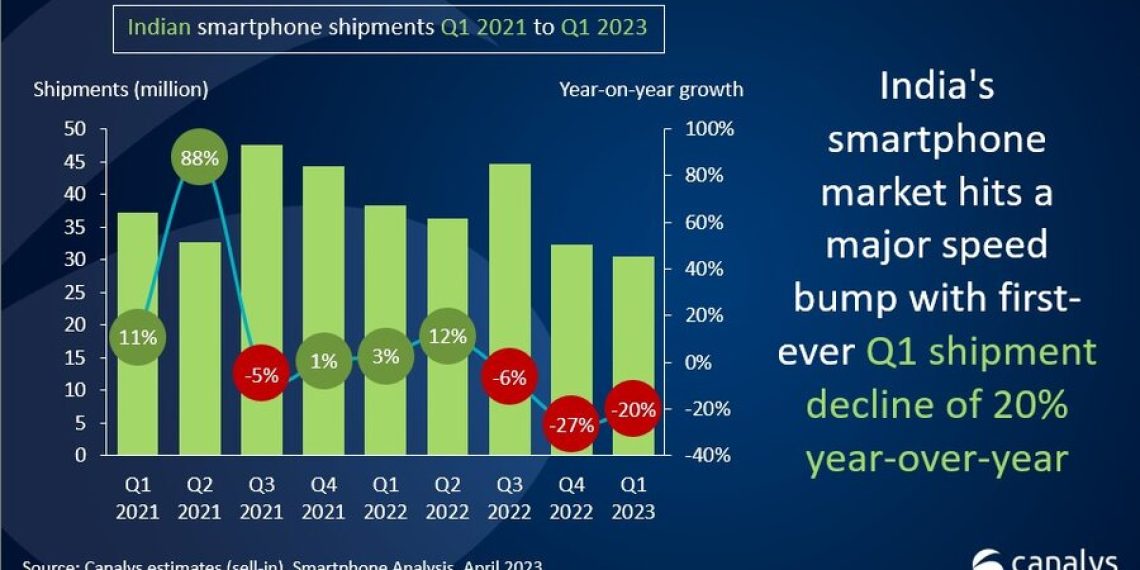

India’s smartphone market, the second-largest in the world, has experienced its first-ever decline in Q1 shipments by 20% YoY, according to a report. The main reason cited for the decline is uneven demand difficulties caused by the economic situation towards the end of Q4 2022. Canalys research also suggests that cell phone sales channels remain vulnerable to stock development.

Analysts believe that this decline in shipments is temporary and the long-term prospects of the Indian smartphone market remain positive. Major brands continue to invest in India, in line with the government’s vision and shifting consumer behavior. They are focusing on improving retail, manufacturing, local sourcing, and R&D to solidify their long-term position in the market.

Samsung Maintains Top Position

Despite the decline, Samsung remains the top brand in the Indian smartphone market, with a 21% market share in Q1 2023, shipping 6.3 million units. Oppo surpassed Vivo and Xiaomi to take the second position, shipping 5.5 million units. Vivo came in third with 5.4 million shipments, owing to its strong offline channels. Xiaomi fell to fourth place with 5 million shipments, while Realme took fifth place, shipping 2.9 million units due to a muted online channel.

Samsung’s success in the Indian market is attributed to its ability to place fast-moving models effectively in the offline market. The brand’s new, 5G-capable A-series was the focus of this quarter. Meanwhile, Apple is also making a move in the Indian market with the launch of new offline stores that are staffed by expert workers. This move is expected to further enhance the brand’s image and position in the market.

Balancing Channel Contributions

Canalys Analyst Sanyam Chaurasia emphasizes that brands must balance channel contributions to maintain stable business operations and share. Brands with productive channel management have shown to be stronger to market unpredictability. Vendors have shown stability even during market downturns by cultivating primary retail channels. The increasing contributions from high-price band models have encouraged vendors to focus on strengthening their offline channels.

In conclusion, the Indian smartphone market’s Q1 decline is a temporary setback, and long-term prospects for the market remain positive. Brands are investing in India and focusing on strengthening their retail, manufacturing, local sourcing, and R&D to solidify their position in the market. Balancing channel contributions is also essential for stable business operations and share.