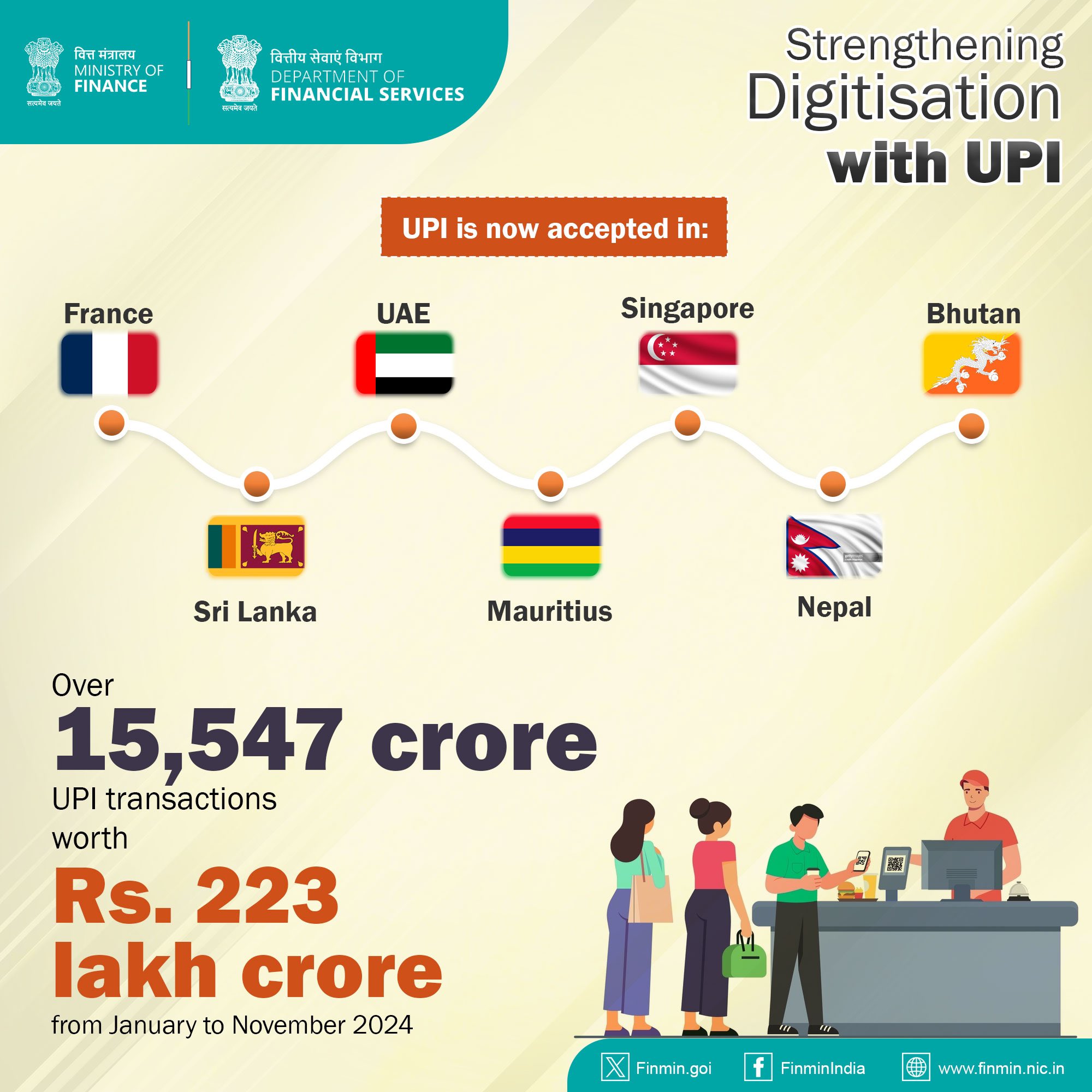

The Unified Payments Interface (UPI) has emerged as a game-changer in India’s digital economy, achieving a monumental milestone in 2024. UPI processed an astounding 15,547 crore transactions between January and November, amounting to a record-breaking Rs 223 lakh crore, as reported by the Finance Ministry. This phenomenal growth underscores UPI’s transformative role in driving financial inclusion, streamlining transactions, and enabling a shift toward a cashless economy. With its robust infrastructure, global expansion, and increasing consumer trust, UPI is not only revolutionizing payments in India but also making waves on the international stage.

Key Highlights

Unprecedented Volume: UPI processed 15,547 crore transactions between January and November 2024.

High Transaction Value: The total transaction value reached Rs 223 lakh crore.

Global Expansion: UPI operates in seven countries, including the UAE, France, and Singapore.

Rapid Growth: October 2024 alone recorded 16.58 billion transactions worth Rs 23.49 lakh crore.

Enhanced Accessibility: UPI empowers small businesses, street vendors, and migrant workers.

Secure Platform: The system leverages robust technology, fostering trust and ease of use.

Leadership in Real-Time Payments: India now accounts for 49% of global real-time payment transactions.

The Evolution of UPI: A Catalyst for India’s Cashless Economy

Launched in 2016 by the National Payments Corporation of India (NPCI), UPI has redefined how India handles money transfers. It enables users to integrate multiple bank accounts into a single mobile app, simplifying processes for:

Fund transfers

Merchant payments

Peer-to-peer transactions

The system has been a significant driver of India’s shift towards a cashless economy, offering scheduled payments, instant transfers, and secure transactions. UPI has gained the trust of millions, ensuring reliability and accessibility across demographics.

October 2024: A Record Month

In October 2024, UPI hit a new peak, processing:

16.58 billion transactions

Transactions worth Rs 23.49 lakh crore

This marked an impressive 45% year-on-year growth, solidifying UPI’s dominance in India’s payment sector. With 632 banks now connected to the platform, it offers unprecedented scalability and convenience.

UPI’s Global Footprint

UPI’s success story extends beyond India, with operations in seven countries, including:

The UAE

Singapore

Bhutan

France

France, notably, became the first European country to adopt UPI, enabling seamless payments for Indian consumers and businesses. This global expansion reflects India’s innovation in payment technology and its potential to shape the future of digital transactions worldwide.

UPI and Financial Inclusion

One of UPI’s standout achievements is its role in promoting financial inclusion. Small businesses, street vendors, and migrant workers have benefitted immensely, gaining access to efficient payment systems.

The pandemic further accelerated UPI adoption as contactless transactions became essential. This cultural shift toward digital payments has driven UPI’s widespread acceptance and trust.

Driving Innovation and Trust

UPI’s exponential growth is supported by:

Robust Infrastructure: A scalable and secure platform.

Consumer Behavior Shift: A preference for digital transactions over cash.

Spam Protection: Advanced AI-based systems flagging billions of spam calls and SMS, enhancing user safety.

According to the ACI Worldwide Report 2024, India leads the world in real-time digital payments, accounting for 49% of global transactions in 2023.

Transformational Future

UPI’s accomplishments are more than milestones; they signify a paradigm shift in how payments are perceived and utilized. As India spearheads the global digital payment revolution, UPI is poised to remain a cornerstone of financial inclusion, security, and innovation.

Follow Before You Take on Facebook | Twitter | WhatsApp Channel | Instagram | Telegram | Threads | LinkedIn, For the Latest Technology News & Updates | Latest Electric Vehicles News | Electronics News | Mobiles News | Software Updates