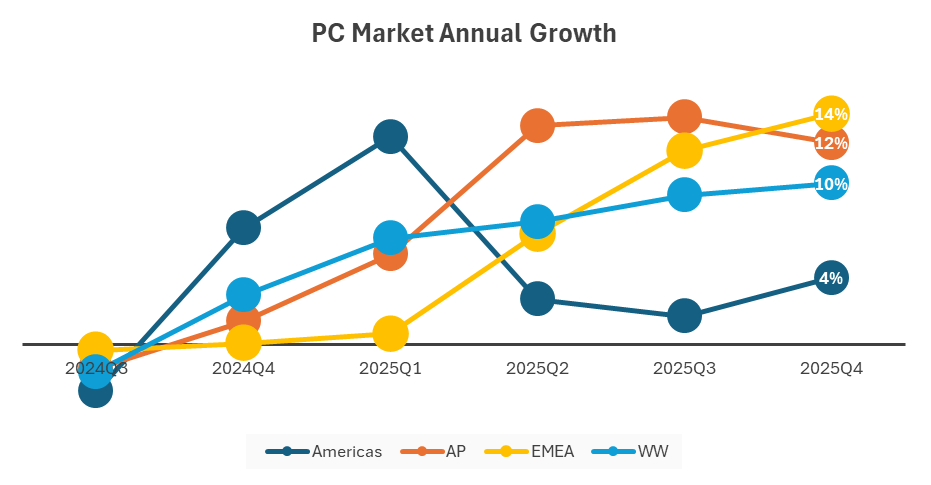

The global PC market closed 2025 on a strong note, posting one of its most significant growth phases in recent years. According to the latest Worldwide PC Market Tracker report from International Data Corporation (IDC), worldwide PC shipments grew 9.6% year-on-year (YoY) in Q4 2025, reaching 76.4 million units. For the full year, total PC shipments climbed to 284.7 million units, marking an 8.1% increase compared to 2024.

While the numbers highlight a healthy recovery and renewed demand, IDC warns that 2026 could look very different, as an intensifying global memory crisis threatens to disrupt pricing, configurations, and competitive dynamics across the PC industry.

What Drove PC Market Growth in 2025?

IDC analysts describe 2025 as a broadly positive year for the PC industry, supported by multiple overlapping demand drivers.

Windows 10 End-of-Support Fuelled Upgrades

One of the biggest contributors was the approaching end of support for Windows 10, which encouraged enterprises and consumers alike to upgrade aging systems. Many organizations accelerated refresh cycles to avoid security and compatibility risks, boosting commercial PC demand.

Inventory Pull-Forward and Tariff Concerns

Early in the year, tariff-related uncertainty, particularly tied to policy discussions under former US President Donald Trump, prompted vendors to pull forward inventory. This resulted in higher-than-expected shipments earlier than planned, adding momentum to overall annual volumes.

Holiday Season and Component Price Anxiety

A strong holiday shopping season further supported Q4 sales. At the same time, growing concerns around memory pricing and availability pushed both vendors and buyers to act sooner rather than later, contributing to the sharp year-end surge.

PC Market Leaders in 2025: Who Gained the Most?

Lenovo Retains Global Leadership

Lenovo emerged as the clear market leader in both Q4 and full-year 2025. The company captured a 25.3% market share in Q4 and shipped 61.8 million units across the year, delivering a robust 14.5% annual growth rate.

HP and Dell Hold Strong Positions

HP secured the second spot, finishing 2025 with a 20.2% market share, while Dell ranked third with 14.4% share. Dell stood out in Q4, posting an impressive 18.2% YoY growth, one of the strongest quarterly performances among major vendors.

Apple Shows Steady Long-Term Momentum

Apple maintained its fourth-place ranking in both Q4 and full-year standings. While Q4 growth was nearly flat at 0.2% YoY, Apple recorded a solid 11.1% growth for the full year, shipping 25.6 million units in 2025—highlighting consistent demand for Mac systems.

ASUS Rounds Out the Top Five

ASUS claimed the fifth position, shipping 20.5 million units in 2025. With a 7.2% market share and 13.4% annual growth, ASUS delivered the second-highest growth rate of the year, trailing only Dell.

Memory Crisis: The Biggest Threat Heading Into 2026

Despite the strong performance in 2025, IDC cautions that the PC market is entering a period of heightened uncertainty due to a growing global memory shortage, largely driven by the rapid expansion of AI-related workloads.

Lower Memory Configurations Likely

To conserve limited memory supplies, vendors may begin shipping PCs with lower average memory specifications, particularly in entry-level and mainstream systems. This shift could affect user experience and slow replacement cycles for certain buyer segments.

Rising Prices and Premium Focus

IDC also expects average selling prices (ASPs) to increase, as manufacturers prioritize midrange and premium systems to protect margins amid rising component costs. Some OEMs have already announced price hikes, signaling what could become a broader industry trend.

Large Brands Set to Benefit, Smaller Vendors at Risk

According to IDC, the evolving memory situation could significantly reshape competitive dynamics over the next 12–24 months.

Scale Will Matter More Than Ever

Major global brands such as Lenovo, HP, and Apple are better positioned to navigate the crisis due to their scale, purchasing power, and secured memory allocations. These advantages could allow them to capture market share from smaller and regional PC vendors.

Survival Challenges for Smaller Brands

IDC warns that prolonged shortages may push some smaller brands out of the market entirely. Consumers—especially DIY PC builders and price-sensitive buyers—may delay purchases, downgrade specifications, or redirect spending to other devices and experiences.

IDC’s View: A Volatile Year Ahead

Jean Philippe Bouchard, Research Vice President at IDC, noted that the pace at which the memory situation is evolving could dramatically alter the PC landscape within a year. Beyond pricing pressure, he highlighted the possibility of reduced memory configurations becoming the new norm as vendors try to stretch limited inventories.

Jitesh Ubrani, Research Manager at IDC, added that the shortage is affecting the entire ecosystem and could reshape market dynamics for at least the next two years. While large brands are likely to strengthen their positions, the uncertainty poses real risks for smaller players and could change consumer buying behavior.

Conclusion

The global PC market delivered an impressive performance in Q4 and full-year 2025, driven by upgrade cycles, inventory strategies, and seasonal demand. However, the emerging memory crisis is set to challenge this momentum in 2026, potentially leading to higher prices, lower base specifications, and a more consolidated market.

As IDC suggests, the year ahead could be one of the most volatile periods the PC industry has seen in recent times—where supply constraints, AI-driven demand, and shifting consumer priorities redefine how PCs are built, priced, and sold worldwide.

Follow Before You Take on:

Latest Technology News | Updates | Latest Electric Vehicle News | Updates | Electronics News | Mobile News | Updates | Software Updates

📌 Facebook | 🐦 Twitter | 📢 WhatsApp Channel | 📸 Instagram | 📩 Telegram | 💬 Threads | 💼 LinkedIn | 🎥 YouTube

🔔 Stay informed, Stay Connected!